Today’s Market Trend

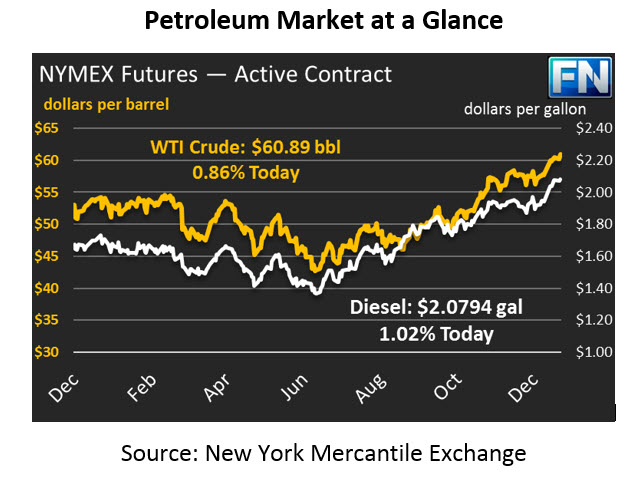

Markets are rising once again, propelled by instability in Iran. After small 17 cent gains yesterday, crude oil is up 52 cents (0.9%) today, trading at $60.89.

Refined fuel prices took a hit yesterday, experiencing losses of 0.5% (diesel) and 1.7% (gasoline). Today, markets are reversing their losses. Diesel prices are currently up 2.1 cents (1.0%) to trade at $2.0794. Gasoline has experienced smaller gains, but is up 1.6 cents (0.9%), giving a price of $1.7792.

Just a few short weeks ago, this publication forecast a correction followed by an advance. With CFTC data showing near-record high bullish sentiment, a pullback seemed likely – at some point, traders have to cash in their bets and walk away with their profits. Yet prices have risen $3/bbl since then! The latest CFTC data, from Dec 26, showed bullish sentiment rise to its highest level since peaking in early 2017. With markets at a record high, why has there not been a reversal?

The answer is Iran. Protests in the country have added significant instability to oil prices, adding a bit more upside to prices. It’s worth noting, however, that protests so far have not disrupted any oil flows. In addition, technical analysts expect little resistance between current prices and $63. Because many market traders subscribe to technical analysis, the uptrend could keep them in the market for a bit longer. Once markets find a bit of upward resistance, expect a temporary correction, which could be followed by lower prices or a resurgence of bullish sentiment.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.