Today’s Market Trend

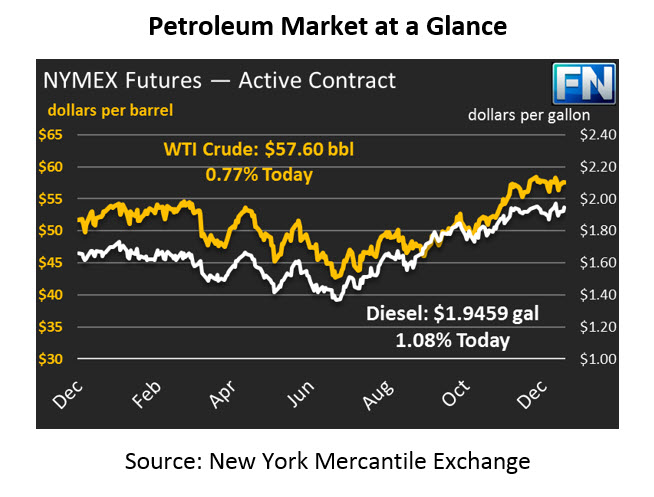

Oil markets are trading higher this morning after lackluster results yesterday. Crude oil yesterday saw small losses of 21 cents. Prices picked up 14 cents overnight, counteracting most of Monday’s losses, and today prices are continuing higher, with prices currently at $57.60, trading 44 cents (0.8%) above yesterday’s closing price.

Refined products both enjoyed moderate gains yesterday, accompanied by growth today. Diesel prices picked up 2.1 cents (1.1%) yesterday, ending with the highest closing price since the previous Monday. Today, diesel prices continue their ascent, trading up 2.1 cents (1.1%) at $1.9459.

Gasoline prices saw similar gains, rising steadily throughout the day to add 1.7 cents (1.0%). Today, prices continue to rise, picking up 1.9 cents (0.8%). Gasoline prices are currently trading at $1.6725.

Last week, we mentioned that one of Nigeria’s largest labor unions had threatened to strike after the layoff of workers at certain oil fields. Yesterday, the union announced a beginning to their strike. Markets didn’t have long to react before the strike had ended, as Nigerian negotiators agreed to rehire many of the workers. Crude markets did pick up almost 40 cents when the strike started, but quickly gave up those gains when it ended the same day.

Holiday trading is often less enthusiastic than the rest of the year. CFTC data shows that Managed Money Net Length (institutional investors’ net amount of long and short trading positions) remains near record highs, though it fell slightly lower again on Friday. With traders already heavily invested in the market, upward market movement in the short-term seems unlikely. Traders will at some point have to cash in their contracts to take in profits, resulting in a sell-off that could cause a brief down-turn in the market. Whether that becomes a full correction (10% price drop) or not is yet to be seen.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.