Today’s Market Trend

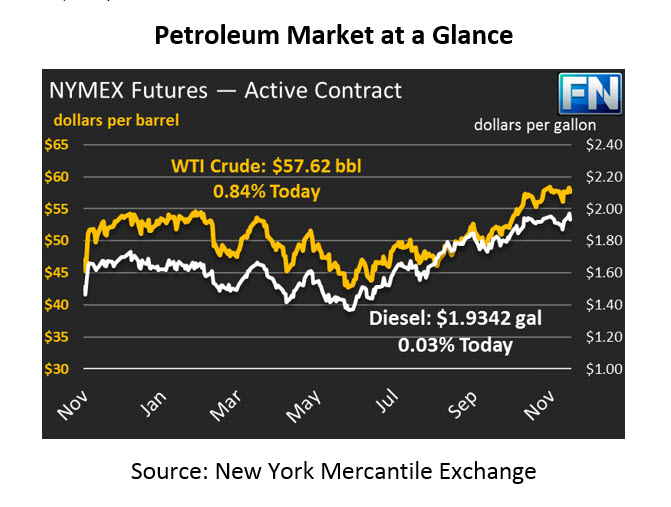

Oil markets took a hit yesterday with a mix of bullish and bearish factors. Prices opened yesterday just above $58/bbl, but ended the day at $57.14. Overnight, crude gained some ground. This morning, prices are trading 48 cents (0.8%) higher at $57.62.

Refined products saw similar losses yesterday, with diesel and gasoline both giving up 1.0% during the trading session. Today, prices are trending flat. So far, diesel prices have stabilized and are trading flat at $1.9342. Gasoline are in the same boat, picking up a mere .1 cents to trade at $1.6983.

A number of announcements yesterday pushed markets up and down. The API released their weekly inventory data, which was generally perceived as supportive of fuel prices. Crude inventories saw stocks by double the market expectation – a notable 7.4 million barrel draw. Fuel produces saw inventory builds, but those builds were in line with market expectations. Markets will be watching to see if the EIA confirms the large inventory draw.

Countering the API data was the EIA’s Short-Term Energy Outlook, which showed that U.S. crude production grew by 360 kbpd in November, a result of offshore rigs coming online after Hurricane Nate. The agency also increased its expectation for Non-OPEC supply, offsetting OPEC’s cut extension. OPEC also released their monthly oil market report, which showed rising U.S. production and an overall increase in global oil supplies in 2018.

Adding to the bearish pressures, the Forties pipeline is expecting repair work to be much quicker than previously thought. The Forties pipeline is a major crude pipeline feeding the U.K., and its outage will take roughly 300 kbpd off the market. The pipeline is a major supply chain component of Brent crude oil, meaning that the change disproportionately affected Brent crude prices. On Monday, Brent-WTI spreads hit a high of $7.26, the highest seen since 2015. Now that the repair time is estimated to be two weeks at most, the spread has fallen back to its current level of $6.06.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.