Today’s Market Trend

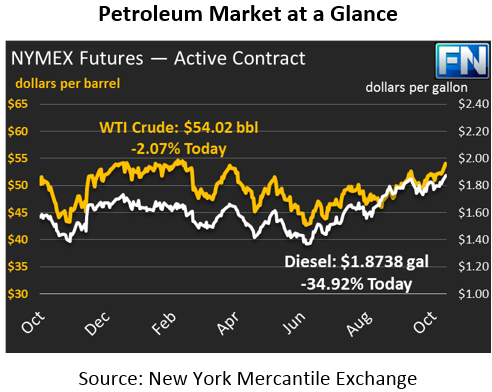

Oil markets are flat this morning after a strong day of trading on Friday. Crude oil gained $1.10 during Friday’s session closing at $53.90. After a quiet weekend, prices have retained their strength and are currently $54.02. Brent saw a strong day on Friday as well with prices settling above $60/bbl for the first time since July 2015.

Refined products followed Crude on Friday and this morning. Diesel prices gained 2.5 cents on Friday, while gasoline gained just under 2 cents. Today, both products are holding onto their gains, trading generally flat to slightly higher. Diesel prices are currently $1.8738, a gain of 69 points (.37%), while gasoline prices are down 68 points (.38%) to $1.7754.

Markets continue to focus their attention on the potential extension of OPEC cuts. Wall Street Journal reported over the weekend that Saudi Arabia’s Crown Prince Mohammed bin Salman reiterated the countries support of extending OPEC’s production cuts. OPIS notes that Saudi Arabia is the largest and most influential member of the Organization of the Petroleum Exporting Countries (OPEC), and has the second-largest proven oil reserves in the world. On domestic news, Baker Hughes Crude Oil Rig Count rose by 1 rig to reach 737 after three consecutive weeks of declines. OPEC output cuts are giving U.S. producers an advantage to increase production due to a higher price.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.