Today’s Market Trend

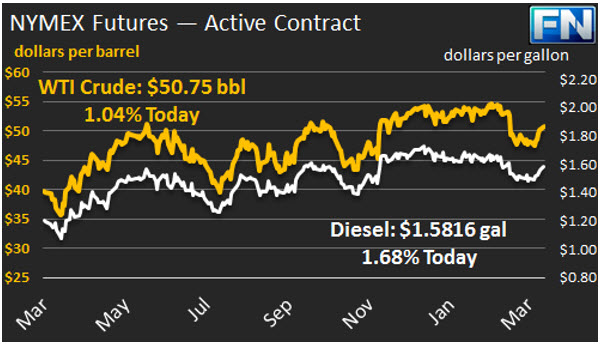

WTI crude prices are at approximately $50.75/b this morning. Friday’s prices opened above $50/b for the first time in three weeks, and prices remained strong during the day, allowing WTI to end solidly in the black for the week. WTI opened at $50.69/b today, an increase of $0.37, or 0.74%, above Friday’s opening price. Current prices are $50.75/b, up $0.15 above Friday’s close. Product prices also remained strong Friday, ending the week in the black.

Diesel opened at $1.5729/gallon in today’s session. This was an increase of 1.09 cents, or 0.7%, from Friday’s opening price. Current prices are $1.5816/gallon, up 0.70 cents from Friday’s close.

Gasoline opened at $1.7007/gallon today, an increase of 1.17 cents, or 0.69%, from Friday’s opening. This was the highest opening price since Match 1st. Prices are $1.7101/gallon currently, an increase of 0.71 cents from Friday’s close.

On Friday, Baker Hughes released its rig count data for the week ended 3-31-2017, showing an addition of 15 rigs (10 oil-oriented and 5 natural gas-oriented,) bringing the U.S. total to 824 active rigs. This is the largest number of active rigs since September 2015. During the first quarter of 2017, the U.S. rig count increased every week except for one. At the end of December 2016, the rig count stood at 658. At the end of March 2017, 166 rigs had been added to the active count, bringing the total to 824. From the end of December through the week ended March 24th, 2017, U.S. crude production has risen by 377 kbpd, according to the EIA.

The rise in U.S. output continues to contribute to high inventory levels. This was one of the key factors causing prices to sag in March, but has not fully countered the impacts of the OPEC/NOPEC product cut pact. The OPEC Secretary General announced that Iraq had pledged to fully meet its production cut level. Iraq’s Oil Minister sad that the country’s compliance level had hit 98%. It is possible that some Iraqi production cuts will be unintentional, since Bloomberg reported over the weekend that tensions had escalated in the Kirkuk oil field.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.