Today’s Market Trend

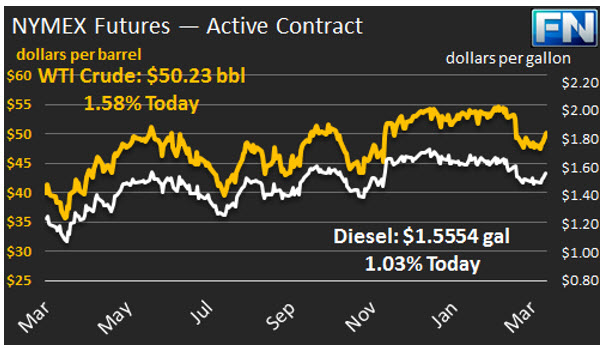

WTI crude prices are back above $50/b this morning for the first time in three weeks. WTI opened at $50.32/b today, an increase of $0.72, or 1.45%, above yesterday’s opening price. Current prices are $50.23/b, down $0.12 below yesterday’s close. Product prices also strengthened yesterday and appeared to plateau overnight, with some pre-weekend profit taking.

Diesel opened at $1.562/gallon in today’s session. This was an increase of 1.6 cents, or 1.03%, from yesterday’s opening price. Current prices are $1.5554/gallon, down 0.28 cents from yesterday’s close.

Gasoline opened at $1.689/gallon today, an increase of 1.9 cents, or 1.14%, from yesterday’s opening. Prices are $1.6775/gallon currently, a decrease of 0.37 cents from yesterday’s close.

This week’s EIA data showed several developments that were constructive for prices. First, although there was another increase in crude inventories, it was relatively small at 0.867 mmbbls, and it was overwhelmed by drawdowns of 3.747 mmbbls of gasoline and by 2.483 mmbbls of diesel. Crude runs jumped 425 kbpd as numerous refineries came out of Spring maintenance.

The news from OPEC is also strengthening prices. Output from Libya continues to be constrained by renewed violence, taking around 250 kbpd off the market. OPEC compliance with the production cut agreement is high, though compliance among the Non-OPEC participants is lagging. Nonetheless, the agreement is only three months along, and the participants are considering an extension of the cuts. The possibility that this could be achieved received a boost when Iran and Russia held discussions regarding continued cooperation in the agreement. Russia has not yet fully cut the 300 kbpd to which it has committed, and Iran had been granted leeway to continue to increase production modestly (which it has done.) Therefore, these two countries could contribute considerably more to the OPEC-NOPEC agreement, and their implied willingness to do so adds weight to the pact as whole.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.