Today’s Market Trend

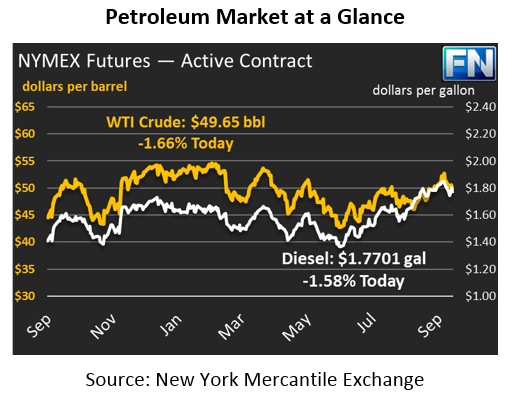

Crude prices rallied yesterday, reversing the losses and closing at $50.79, the highest close of the week. Markets were propelled by news from OPEC that the cuts may be extended to the end of 2018 and new members may be added to the quota. Additionally, yesterday it was reported that 15% of Gulf oil production (3% of U.S. total oil production) had been shut in by Tropical Storm Nate. Today, markets have turned down once again, apparently not quite convinced by OPEC’s announcements. Crude prices are currently $49.65, down over a dollar (2.2%) from yesterday’s closing price.

Refined products are following crude lower this morning, though they have not fallen quite so quickly. After strong trading yesterday and early this morning, Diesel prices are down to $1.7682, a 1.6 cent drop (.91%) from yesterday’s closing price. It’s an even larger fall from today’s opening price of $1.7925.

Gasoline is also lower this morning, shedding a mere .72 cents (.5%) to the current price of $1.6042. Gasoline gained about 3 cents yesterday, so today’s losses have not been able to offset the overall higher prices since yesterday’s open.

President Trump is expected to announce that the Iran nuclear deal is not beneficial to U.S. security in the coming week, which could significantly impact markets. Back in July 2015, when the Iran deal was signed and sanctions were lifted, Iranian oil flooded the market, sending prices from the high $50s down to the $40 range. Iran exports nearly 2 million barrels per day (Mbpd) of oil, roughly 2% of global supplies, meaning that a removal of their supplies could send shockwaves through markets. Trump’s announcement will not automatically trigger new sanctions; Congress will have to vote on sanctions, and right now they seem hesitant to do that. Trump has until October 15 to certify whether the Iran nuclear deal is in the best interests of U.S. national security.

Libya output resumed yesterday at the El Sharara oil fields. El Sharara is Libya’s largest oil field, but has been on-and-off in recent months due to ongoing instability in the area. As of yesterday, production was at 200 kbpd, bringing new supplies to the market.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.