Today’s Market Trend

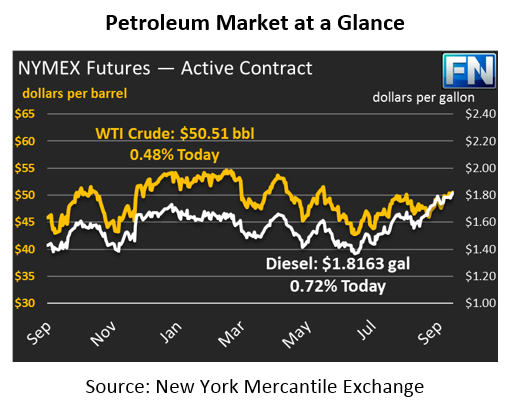

It’s Friday, and after weeks of choppy trading markets appear ready for an easy lead-in to the weekend. Crude prices are down just 4 cents to $50.51 this morning. Prices have ranged between $50-$51 since Wednesday, a very small window.

Diesel movements are equally narrow, moving a tenth of a cent lower to $1.8163 after small gains yesterday. Diesel prices are at 2-year highs, and they appear to be settling in at higher rates. Unlike gasoline, diesel prices have not fallen to pre-Harvey levels; they’ve only continued to rise.

Gasoline prices have been a bit more rambunctious on this quiet Friday, gaining 1.5 cents to reach $1.6590 this morning. Gasoline prices have been up and down all week, and yesterday saw prices range from a low of $1.620 up to $1.655, a 2% variation.

OPEC and non-OPEC members of the production cuts are meeting in Vienna today to discuss compliance rates. In July, compliance rates were 94%; the organization will be discussing August compliance and looking to the future to see if more actions are needed. Rumors hold that OPEC is considering two different options – a 1% decrease in production, or an export quota for countries to prevent them from using inventories to supplement revenues. Another option would be to require Nigeria and Libya to agree to material production cuts. The last announcement from OPEC about a deal extension to March 2018 was met with a significant price drop; OPEC must do more if they want to prop up markets in the short term. Perhaps an announcement from OPEC later today will wake up today’s sleepy market.

With diesel prices remaining strong, refiner margins have been pushed higher, helping to light a fire under the recent crude oil increase. As we mentioned, crude prices have broken above the $50 for the first time in a couple months, and have so far stubbornly held above the key price level. Over the last few months, crude prices have struggled to stay over $50, with prices typically falling in the week after prices hit $50. We’ll have to watch next week to see if the pattern holds.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.