Today’s Market Trend

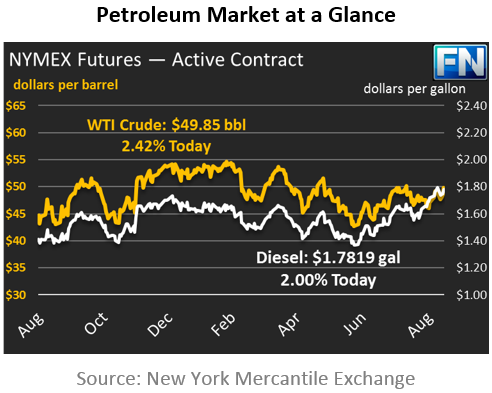

Oil markets are down across the board following price gains yesterday. Crude prices managed to break through the $50 for a whole night, closing the trading session yesterday at $50.69. This morning prices are down slightly, though still above the $50 level (at least for now) at $50.27.

Diesel prices also finished the day above a key level, closing above $1.80 for the first time since July 2015. Prices are currently $1.8033, down just .37 cents from yesterday. As we’ve mentioned before, diesel’s strength is coming from three factors – 1) generators and disaster response vehicles responding in the Gulf and Florida, 2) cooler weather creating demand for heating oil, and 3) fall harvest season.

Gasoline prices have struggled lately, as more refineries come back online and the summer driving seasons comes to an end. Prices fell by just under a penny yesterday, and today have continued their downward spiral by shedding 1.89 cents. Prices are currently $1.6362, 4 cents off their Tuesday high of over $1.67.

The EIA released its inventory data, which was far less bullish for crude and gasoline than the API’s data, though the two sources were close on diesel stocks. Harvey continues to affect oil inventories. Crude stocks rose by 4.6 million barrels (MMbbls). In the past three weeks, crude stocks have gained 15 MMbbls, and are now less than 2 MMbbls below their levels last year. Gasoline is now officially below 2015 levels for the first time in two years, and is just 3 million barrels above 5-year averages. Diesel remains far below 2015 and 2016 levels for this time of year.

Demand has begun to outstrip supply, and drawdowns of refined products have been larger than crude stock builds. Early in the year, analysts foretold that OPEC’s production cuts wouldn’t severely impact supplies until Q3 and Q4 2017. Now that we’re here, we can see that OPEC’s cuts are indeed impacting supplies. Physical crude markets have tightened internationally, as we’ll see in today’s second article. Many price indexes have flipped to backwardation, where future prices are lower than market prices today. Backwardation incentivizes suppliers to sell their inventories today, since they’ll get a higher price today than they can guarantee in the future.

Our second article today comes from the EIA, and shows how OPEC’s cuts have affected the balance of different crude qualities and caused physical prices to grow tighter for heavy crudes, while light crudes (like WTI crude, the reported index in the U.S.) have fallen due to surging production from the U.S.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.