Today’s Market Trend

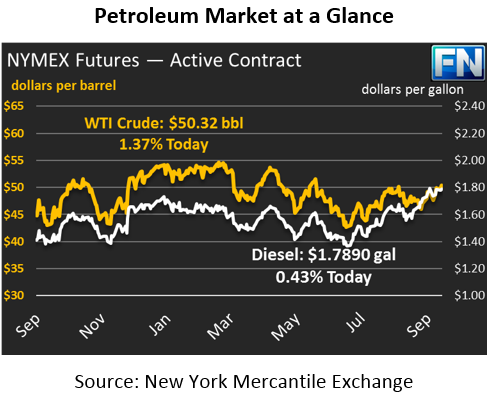

Crude prices are moving higher this morning after trending flat yesterday and overnight. Crude prices are $50.32, up $.41 from yesterday’s close. As we stated yesterday, crude prices have struggled to stay above $50 – after prices broke through the $50 ceiling yesterday morning, they fell back down to close the day at $49.91. The last time crude closed above $50 was July 31; the last time crude closed above $50 two days in a row was in May. Markets are struggling to push above that level as inventories worldwide remain high, though supply/demand fundamentals have improved in the last month.

Refined products have been mostly flat. Diesel prices are up by almost a penny this morning, after losing nearly two cents yesterday. Diesel prices remain elevated, pushing 2-year highs above $1.80. Unlike crude, which has bounced of $50 numerous times this year, diesel prices have not been this high since 2015, so it’s difficult to know which direction they’ll go.

Gasoline prices are flat today, still havering in the mid-$1.60 range. Gasoline is $1.6694, hardly moved from yesterday’s opening price of $1.6615. Prices have been oscillating in the $1.62-$1.67 range over the past few weeks, relatively stable following extreme volatility during Hurricane Harvey when 25% of U.S. refining capacity was taken offline. At the regional (“cash”) market level, prices are beginning to normalize. Basis prices (the difference between regional prices for physical fuel and NYMEX futures) has fallen back to pre-Harvey levels now in most areas; Chicago has even seen gasoline basis drop lower. Local gasoline prices surged 20-40 cents higher during the peak of the two storms, compared to diesel basis which only moved 5-10 cents.

The US Dollar continues falling, which has given oil markets some extra strength. Prices performed strongly last week, but news of North Korea firing a missile over Japan, as well as overall concerns about the economy following the destruction of Harvey and Irma, have caused prices so fall lower once again.

OPEC is reportedly considering deepening production cuts by 1%, which has helped markets rally back to the $50 level. That would represent a roughly 300 – 480 kbpd reduction in crude production from OPEC (and perhaps agreeing non-OPEC countries), which would bring further strength to supply fundamentals. Whether OPEC will be able to agree on this cut or not is yet to be seen – cash starved countries who are already cutting production may not want to further decrease their revenue. Deepening cuts will almost certainly increase prices, which just incentivizes cheating, mitigating the upward price impacts. It’s a classic prisoner’s dilemma that Saudi Arabia has thus-far propped up by unilaterally cutting production deeper than they committed. How long the situation can hold is anyone’s guess.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.