Today’s Market Trend

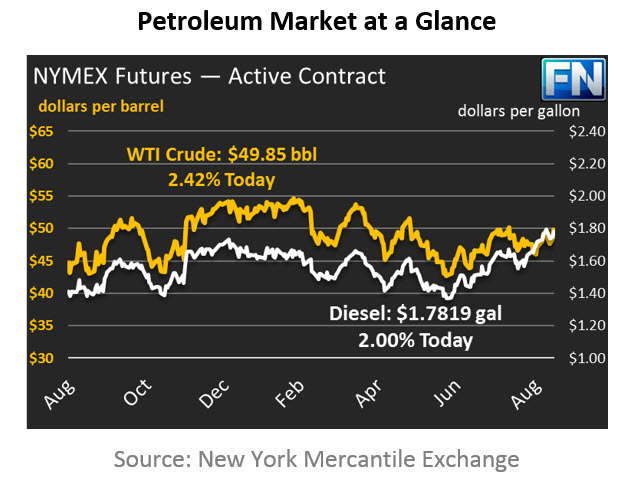

Lifted by bullish data from OPEC, the EIA, and the IEA, crude prices are up this morning to $49.85, a gain of $1.51 from yesterday’s opening price. Prices rose throughout the day yesterday, picking up nearly a dollar during the day. This morning continues the rise, with prices gaining 55 cents since their close last night.

Refined products have been more mixed. Gasoline prices fell yesterday and remain down, while diesel prices are close to their 2-year high of $1.80. Gasoline prices continue to fall as refineries come back online and run rates increase in Houston. Prior to Harvey and Irma, gas prices were trading in the $1.57-$1.60 range, so prices seem to be returning to those lower levels. Yesterday, gasoline prices gave up over a penny to close the day at $1.6473. Gasoline prices today are $1.6397, a .76 cent loss from yesterday’s close.

Diesel prices peaked last Friday at $1.7983, the highest level since July 2015. Unlike gasoline, this was not a brief surge followed by a correction – diesel prices have remained high. Since Friday, prices dropped to the low $1.70 range, but today prices are nearing their 2-year high once again. Diesel prices are $1.7819, up 1.34 cents this morning after gaining 2.5 cents yesterday.

The EIA released its inventory data, though you wouldn’t know it by looking at the market. Crude oil stocks gained 5.9 MMbbls, in line with expectations, while gasoline stocks exceeded expectations with an 8.4 MMbbl draw. Traditionally a build for crude stocks would make prices fall, while falling gasoline stocks would cause prices to rise. Markets have been surprisingly level-headed about the inventory report, since the data only shows short-term disruptions, not long-term trends. We’ll see how long that level-headedness lasts.

As we noted yesterday, prices are rising largely in response to bullish reports from the IEA, OPEC, and the EIA. The overall trend showed higher demand estimates for the remainder of the year, mixed with lower production. Part of that low production is related to temporary disruptions (militant attacks on Libya’s El Sharara field, Harvey hitting the Gulf Coast, etc.) which are mostly passed, so next month’s reports may change their tone and highlight September production increases relative to August.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.