Today’s Market Trend

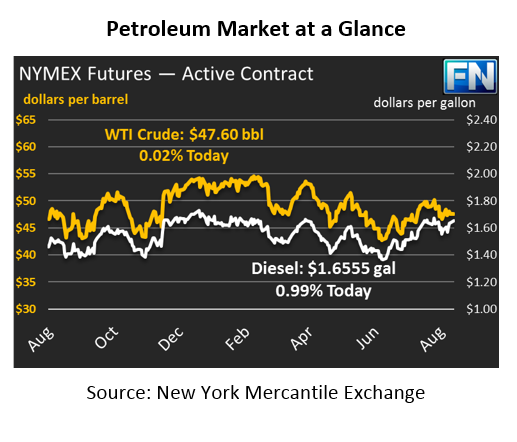

Crude prices remained relatively flat over the weekend despite the volatility from Harvey. On Friday, prices rose a meager $.25, and today they’ve given up that and a bit more. Prices are currently $47.60, a $.27 loss from yesterday’s closing price.

Refined products are significantly higher this morning as a significant portion of Gulf Coast refining capacity has fallen offline. Diesel prices gained over 3 cents overnight, and are currently at $1.6555. Prices on Friday opened two cents above Thursday’s close, then gave up the majority of the gains at the end of the day. Today, prices are once again above the $1.65 level.

Gasoline prices had a similar pattern, opening Friday far higher than Thursday’s close, then giving up the gains as the trading day ended, only to rise higher today. NYMEX gasoline prices are currently $1.7404, a massive $.0738 (4.4%) higher than Friday. Only two days this year have yielded a larger gasoline price increase – March 1, when gasoline futures moved to more expensive summer gasoline formulations, and February 8, when prices soared following a large crude draw. The fact that this price surge came while crude prices remained flat shows the major impact that Harvey is having on markets.

Of course, the largest market mover today is Tropical Storm Harvey, which was downgraded from a Category 4 Hurricane over the weekend after it hit land. Nearly 30 inches of rain have fallen on the Texas coastline, taking 30% of the Gulf Coast’s refining capabilities offline. Approximately 3 million barrels (126 million gallons) of daily refinery production has come offline according to research from Goldman Sachs, driving the surge in refined product prices. Only about 1 MMbpd (42 million gallons) of crude oil production has come offline due to the storm, meaning that a net 2 MMbpd of crude production is going into storage, which explains why crude prices have remained dormant. Importantly, the research group indicates that while production will be reduced for a few days, demand will be reduced for months as the region rebuilds, yielding net lower price impact overall.

Internationally, Libya has declared force majeure in several areas as militants have cut off access to oil fields. Certain pipelines have been shutoff at Libya’s Sharara field, while exports from Mellitah have been reduced.

The Bake Hughes U.S. rig count fell by 4, the second week in a row of declines. Rig counts have been decelerating in recent weeks; this week merely continues that trend. As crude prices have stagnated below $50, bringing new rigs online has not been as profitable, leading U.S. producers to cut back on new rig production.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.