Today’s Market Trend

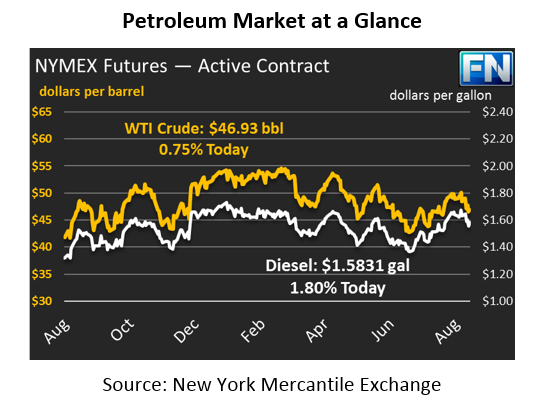

Crude prices are $46.93 this morning, down $.16 (.34%) from yesterday’s close but higher overall than yesterday morning. Prices rose $.29 yesterday, as prices found technical support at the 50-day moving average for WTI. The news this week has been bearish, and markets are staying in line with that trend. Despite a small boost to prices yesterday, it looks like prices will end the week at a loss.

Refined products are mostly flat this morning. Diesel and gasoline prices are trading at comparable prices, with diesel at $1.5831 this morning while gasoline is $1.3874. Gasoline had a strong day yesterday, gaining 1.5% to close the day at $1.5869, likely mean reversion after a particularly hard week.

In the downstream market, refined products had a bumpy day yesterday as news came out that the Pernis refinery, Europe’s largest refinery unit producing over 400 kbpd, had resumed production after being offline for nearly a month. Following that announcement, however, came news that Shell’s Deer Park refinery in Texas was offline, taking with it 270 kbpd of production.

Markets continue to be weighed down by concerns of a 14 MMbbl release of crude oil from the U.S. Strategic Petroleum Reserve. In addition, OPEC imports have risen in August despite Saudi Arabia’s promise to significantly shut off supply to the U.S. Since the U.S. has the most visible oil inventories in the world, OPEC claimed that they would cut down U.S. supply to force inventories lower; however, those claims have not come to fruition.

Atlantic storm activity has been increasing this week, with two storms currently being tracked. We’ll share more information on these systems as they develop.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.