Today’s Market Trend

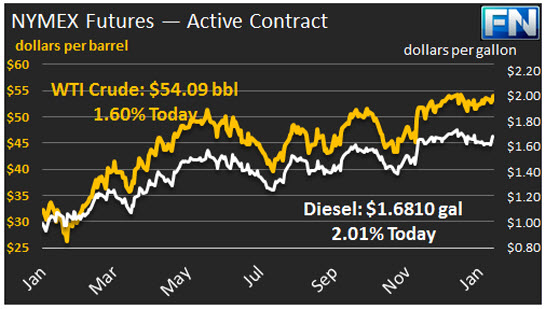

WTI prices have surpassed $54/b this morning, close to where prices opened one month ago on January 3rd. Yesterday, it appeared that WTI would settle back into the vicinity of $53.50/b, but prices spiked in this morning’s early trading. WTI opened at $53.57/b today, an increase of $0.81 from yesterday’s opening price. Current prices are $54.09/b, up $0.21 from yesterday’s close.

Yesterday’s market faltered when the API released its survey data showing a major addition to oil inventories: 5.8 mmbbls of crude, 2.9 mmbbls of gasoline, and 2.3 mmbbls of distillate. The official release of EIA data yesterday showed an even larger build: 6.466 mmbbls crude, 3.866 mmbbls gasoline, and 1.568 mmbbls distillate.

Surprisingly, the inventory build caused little price impact. The market is placing greater weight on two items: First, the high level of OPEC compliance with the agreed-upon production cuts (approximately 80%,) and second, the steady hand of the Fed at the helm of monetary policy. U.S. economic indicators continue to show strength, though economists have noted that soft economic data, such as consumer confidence surveys, are outpacing the hard economic data that track actual economic activity. According to a statement yesterday from the Fed:

“The Committee expects that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, labor market conditions will strengthen somewhat further, and inflation will rise to 2 percent over the medium term.”

Distillate opened at $1.6709/gallon in today’s session. This was 4.02 cents above yesterday’s opening price. Current prices are $1.681/gallon, up 0.07 cents from yesterday’s close.

RBOB opened at $1.5799/gallon today, a rise of 2.34 cents from yesterday’s opening. Prices are $1.5741/gallon currently, down 0.5 cents from yesterday’s close.

A new source of crude is expected to enter the market this coming month: sales from the U.S. Strategic Petroleum Reserve (SPR.) The volume of crude in the SPR is now well above the volume required by U.S. participation in the International Energy Agency (IEA.) The EIA’s summary follows as our second article today.

This article is part of Daily Market News & Insights

Tagged: distillate, gasoline, prices, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.