Today’s Market Trend

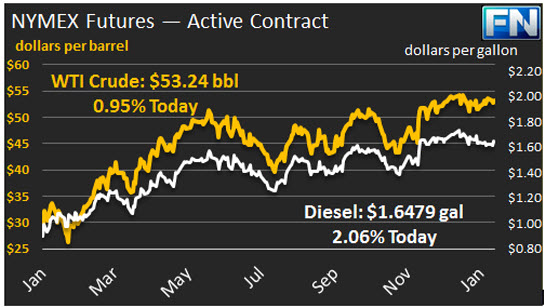

WTI prices reclaimed the price territory above $53/b this morning. Crude and product prices slumped on Monday. WTI crude prices fell below $52.50/b, and remained in this area for most of Tuesday as well. WTI opened at $52.76/b today, an increase of $0.16 from yesterday’s opening price. Current prices are $53.24/b, a gain of $0.43 above yesterday’s close.

Oil prices rallied yesterday when Reuters released its survey information showing that OPEC had achieved 82% compliance with its planned production cuts. This was well above what most forecasts had anticipated. In the past, compliance rates of 50%-65% have been considered successful. A weaker U.S. dollar also contributed to stronger oil prices. The U.S. Dollar Index fell by more than 3% during the month of January. Prices yesterday rose as high as $53.50/b. Yet prices faded when the API released its survey data showing yet another addition to oil inventories: 5.8 mmbbls of crude, 2.9 mmbbls of gasoline, and 2.3 mmbbls of distillate. The bullish impact of strong OPEC compliance appears to be outweighing the bearish impact of the stock build, though the EIA data release today may change the balance.

In the medium term, oil prices should be moderated by the latest EIA forecast. The EIA projects that U.S. crude production will rise from an average of 8.9 mmbpd in 2016 to 9.3 mmbpd in 2018. The EIA’s summary is presented as our second article today.

The Fed will announce its latest monetary policy decision today, but no change is expected in interest rates so soon after the last rate increase.

Distillate opened at $1.6307/gallon in today’s session. This was 2.57 cents above yesterday’s opening price. Current prices are $1.6479/gallon, up 1.71 cents from yesterday’s close.

RBOB opened at $1.5564/gallon today, a major recovery of 5.24 cents from yesterday’s opening. Prices are $1.5778/gallon currently, an additional recovery of 2.77 cents from yesterday’s close.

This article is part of Daily Market News & Insights

Tagged: distillate, gasoline, prices, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.