Today’s Market Trend

Analysis by Dr. Nancy Yamaguchi

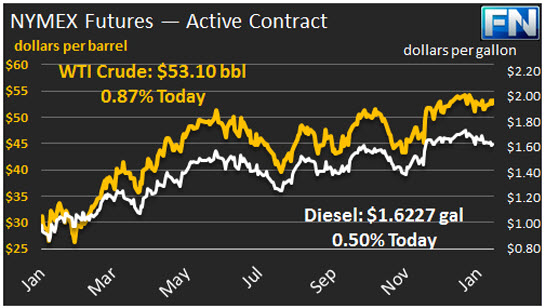

WTI crude prices rallied and are back trading above $53/b. WTI opened at $52.96/b today, up one cent from yesterday’s opening price. Current prices are $53.10/b, $0.35 above yesterday’s close. Product prices have been weaker, partly in response to EIA data showing apparent weekly demand down for all key refined products—gasoline, jet fuel, diesel, fuel oil, propane, and other products.

The EIA released its data on oil stocks yesterday, showing increases across the board: Crude stock additions of 2.84 mmbbls, gasoline stock additions of 6.796 mmbbls, and a small addition to distillate stocks of 0.076 mmbbls. These numbers corresponded reasonably well with the data released by the API the day before: Crude +2.9 mmbbls, gasoline +4.8 mmbbls, and distillate +2 mmbbls. Prices had fallen in response to the API data, and the EIA numbers did not change the picture.

At the top of the economic news: The Dow Jones Industrial Average hit 20,000 yesterday, a record high. Many economists and traders note that the number 20,000 is not magical, and that a decline in key stocks is always possible in the longer term. However, the economic indicators have been strong. Readers may recall that 2016 was the first year since the recession that U.S. unemployment finally fell below 5%. December unemployment was 4.7%. Corporate earnings also began pull out of their slump, and several key U.S. companies, including Boeing, just announced better-than-expected earnings for the 4th Quarter. Market confidence has grown further by the immediate moves by the new President to invest in U.S. infrastructure and promote U.S. industry.

Distillate opened at $1.6166/gallon in today’s session. This was 1.44 cents below yesterday’s opening price. Current prices are $1.6227/gallon, an increase of 1.13 cents from yesterday’s close.

RBOB opened at $1.5598/gallon today, a drop of 2.83 cents from yesterday’s opening. Prices are $1.5207/gallon currently, a decrease of 0.31 cents from yesterday’s close. The volatility of ethanol RINs has added complexity to gasoline markets.

Our second article today comes from the EIA, who have quantified the impact of low oil prices on federal revenues from energy produced on federal lands. Although it is common to note the reduction in OPEC revenues because of low prices, the U.S. government also earns significant revenues. These fell from $14 billion in 2013 to just $6 billion in 2016.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.