Today’s Market Trend

Analysis by Dr. Nancy Yamaguchi

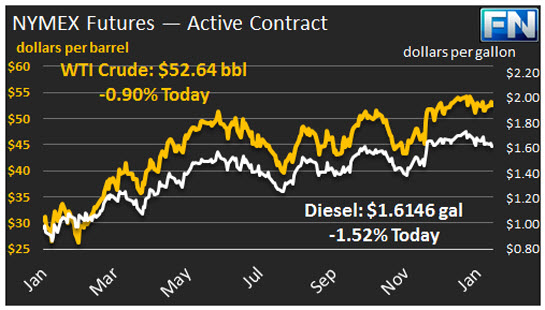

WTI crude prices were unable to cling to $53/b overnight, and they are back in the neighborhood of $52.50-$53/b. WTI opened at $52.95/b today, an increase of nine cents from yesterday’s opening price. Current prices are $52.64/b, $0.54 below yesterday’s close.

The API released its data on oil stocks yesterday, showing increases across the board: Crude stock additions of 2.9 mmbbls, gasoline stock additions of 4.8 mmbbls, and distillate stock additions of 2 mmbbls. As always, the market will watch for the official EIA data release. The data series usually have some differences, but a complete contradiction showing across-the-board stock draws is not expected. Therefore, the market is expecting a stock build, and prices have weakened.

Supply-side concerns may be growing on yesterday’s announcement that the Trump Administration plans to advance the construction of the Keystone XL Pipeline from Alberta and the Dakota Access Pipeline (DAPL) from North Dakota. If completed, Canada would be able to export additional synthetic crudes and bitumen-based products to U.S. refiners, and Bakken area LTOs would gain better pipeline access to U.S. refineries. This would increase the supply of low-cost feedstock in the U.S. Midwest and Gulf Coast markets. Pipelines are regarded as the safest and cheapest mode of oil transport. Nonetheless, there has been an increase of pipeline incidents, and the DAPL route impacts Native American cultural sites and water supplies. Both projects were opposed by the public. Protests against the Dakota Access line escalated into violence. These concerns will not vanish.

Distillate opened at $1.631/gallon in today’s session. This was essentially unchanged from yesterday’s opening price. Current prices are $1.6146/gallon, a decrease of 2.69 cents from yesterday’s close.

RBOB opened at $1.5598/gallon today, a drop of 1.49 cents from yesterday’s opening. Prices are $1.5246/gallon currently, a decrease of 3.33 cents from yesterday’s close.

This article is part of Daily Market News & Insights

Tagged: distillate, gasoline, prices, Refineries, U.S., wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.