Today’s Market Trend

Analysis by Dr. Nancy Yamaguchi

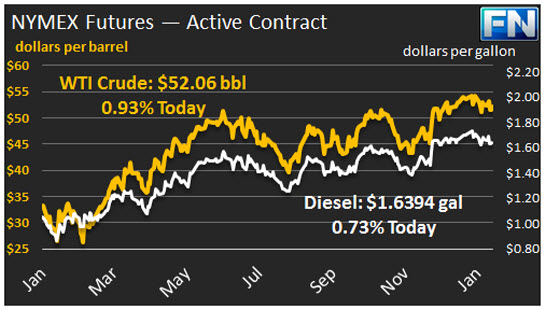

WTI crude prices have regained the $52/b mark this morning, after hovering in the neighborhood of $51.50/b for most of yesterday. WTI opened at $51.45/b today, down six cents from yesterday’s opening price. Current prices are $52.06/b, a significant recovery of $0.69 above yesterday’s close. Crude and product prices are trending up this morning, though the week may still end in the red.

The OPEC production cuts scheduled to begin this month got a head start in December, according to data published by OPEC. OPEC reported that its December output was 220.9 kbpd lower than its November output. Approximately 113 kbpd of this was an unplanned outage in Nigeria, which is not participating in the production cut pact. Saudi Arabia is making its cuts aggressively, however, cutting 149 kbpd in December, and reportedly going well beyond this currently. OPEC reported Saudi Arabian production in December at 10,474 kbpd, and the country recently announced that already it had taken production below 10,000 kbpd in January. Readers will recall that the original agreement made at the November 30th meeting was that Saudi Arabia would cut 486 kbpd. If January’s production averages less than 10,000 kbpd, then the Saudis will already have cut over 600 kbpd.

The market reception to this news was lukewarm, though it did seem to nudge prices back above $51.50/b. It is possible that the market is waiting for signs of compliance from other OPEC countries. A compliance committee meeting is scheduled for this weekend, which seems likely to have a psychological impact (at least) on prices today. There is a spreading unease about global supply expansion in 2017. A high level of OPEC-11 and NOPEC-11 compliance will be needed to counteract this.

The EIA released its data on oil stocks yesterday. The data differed significantly from the API’s estimates this week, and it gave a bearish note to prices. The API data showed a 5.04 mmbbl draw in crude inventories, a 9.75 mmbbl addition to gasoline stocks, and a 1.17 mmbbl addition to distillate stocks. The official EIA data reported a surprise crude stock build of 2.347 mmbbls, a gasoline stock build of 5.951 mmbbls, and a distillate drawdown of 0.968 mmbbls.

Distillate opened at $1.6197/gallon in today’s session, essentially unchanged from yesterday. Current prices are $1.6394/gallon, a recovery of 2.11 cents from yesterday’s close.

RBOB opened at $1.5455/gallon today, down 0.39 cents from yesterday’s opening. Prices have recovered to $1.5661/gallon today, up 3.16 cents from yesterday’s close.

This article is part of Daily Market News & Insights

Tagged: distillate, gasoline, prices, wti crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.