Today’s Market Trend

Analysis by Dr. Nancy Yamaguchi

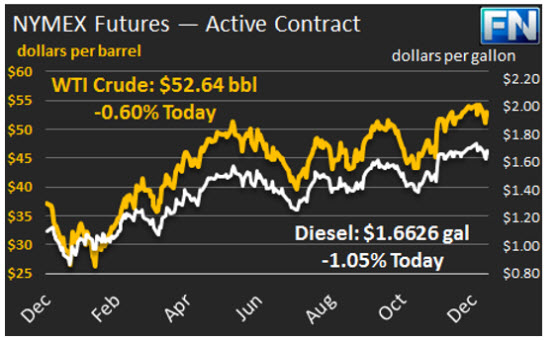

WTI crude prices have receded below $53/b this morning, and they appear to be stabilizing in early trading. WTI prices rose $0.64 yesterday, a second day of price recovery, but much of this has been reversed this morning. WTI opened at $53.05/b today, an increase of $0.68, or 1.3%, from yesterday’s opening price. Current prices are $52.64/b, $0.37 below yesterday’s close.

After a steep downward price correction early in the week, news from OPEC buoyed the market. Saudi Arabia is reported to have already cut production by more than the 486 kbpd it pledged, and its output now is below 10 mmbpd. Kuwait’s Oil Minister stated that Kuwait had cut its production by 133 kbpd, slightly more than the 131 kbpd it had pledged. Its planned output for January is 2707 kbpd. Although compliance is never perfect, the production cuts are underway. It is possible that cuts are starting aggressively and visibly, and that OPEC will make frequent announcements to keep interest high. But as time progresses, compliance may become erratic, and production from members exempt from the agreement (notably Libya and Nigeria) may rise.

Prices also received support from news that Chinese crude imports and refinery runs are forecast to grow by 3.4% in 2017. The U.S. Dollar also has weakened.

Distillate opened at $1.6758/gallon in today’s session. This was 1.81 cents above yesterday’s opening price. Current prices are $1.6626/gallon, down by 1.3 cents from yesterday’s closing. Prices surged in early trading and have subsided since then.

RBOB opened at $1.6158/gallon today, an increase of two cents from yesterday’s opening. Prices are currently $1.6082/gallon today, slightly below (0.26 cents) yesterday’s closing price.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.