Today’s Market Trend

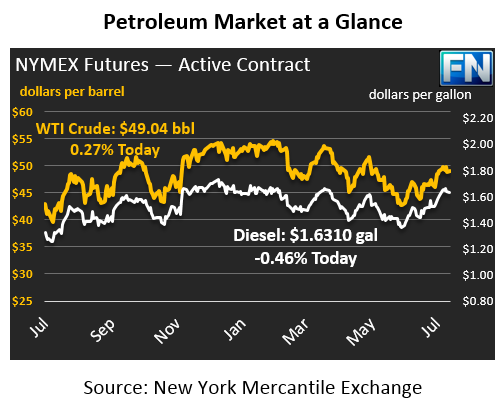

Crude prices are down from Friday’s close by 54 cents to $49.04 (1.09%). Prices closed at $49.58 on Friday, up 63 sent from Friday’s opening of $48.95. This morning opened at $49.59, slightly above Friday’s opening price; however, prices have since declined.

Diesel prices are $1.6310, down by a 1.76 cents since Friday’s close of $1.6486. Gasoline has declined slightly over 2 cents and is trading at $1.6252. Prices opened at $1.6439 and $1.6525, both slightly higher than current prices.

Overall, rig counts have decelerated in the past month after almost half a year of rapid growth. Rig counts lost one rig for the week ended August 4, and are now at 765 (double of 381 rigs a year ago). OPEC and Non-OPEC members are meeting in Abu Dhabi today and tomorrow to discuss member compliance; especially the over-production of Libya and Nigeria, who collectively produced over 600,000 barrels per day over OPEC expectations.

A crisis has been averted as Libya’s largest oil field has resumed production after armed protesters halted pumping for hours according to the country’s National Oil Corp. An explanation of the protesters cause or identity has not been released. El Sharara produces 275,000 barrels per day, which is 3% of total daily barrels produced by the U.S. Had the resolution of the protesters been delayed beyond a few hours at the oil field, the market could have been affected by a significant reduction of supply.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.