This Isn’t Your Normal Cup of Tea – could prices be going lower?

If you are tired of reading about tensions in the Middle East, then you may enjoy today’s editorial. Let’s take a different perspective on the news and read what the “tea leaves” maybe indicating this morning.

Crack spreads, the value difference from crude pricing and the ultimate pricing of the finished products (gasoline and diesel), can be a good indicator of the refining industry’s ultimate margin. Currently, crack spreads are posting at relatively high levels – a futures crack spread is over $24 per bbl. Couple that with the refinery utilization in the U.S. right now, which is slightly below the seasonal norm, and the refining community hears Pink Floyd’s “Money” ringing in their ears – enticing production increases.

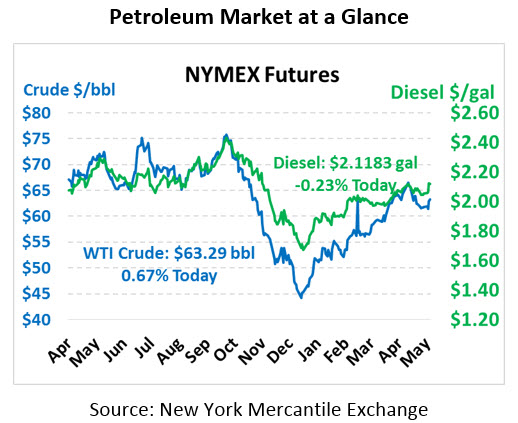

While seasonal demand is starting to crank up for gasoline it may depend on the markets forward thoughts on usage otherwise we may see a drop in prices – correcting a six-month steady climb in fuel prices. There’s not enough room here to write it all but imagine the world’s largest disclaimer about price direction so you know that this comes with a lot of unknowns.

The counter to my price correction could be how hot the U.S. economy is – that includes transportation fuels demand. The Michigan Consumer Sentiment report is due out today. It’s important to note we are hovering over 95%; so whether people have the money to spend or not is irrelevant – fact is they feel comfortable spending it. That increase in spending keeps the trucks, trains, and planes moving, right along with that strong gas demand which may ultimately be the counter to my correction.

Whether this month, next month, or even long-term, the timing anyone’s guess and between the tweets, missiles, and economic reports anything is possible. Whatever direction the market goes at least you didn’t have to read about missiles again – at least not until Monday.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.