The OPEC Seesaw Swings Again…

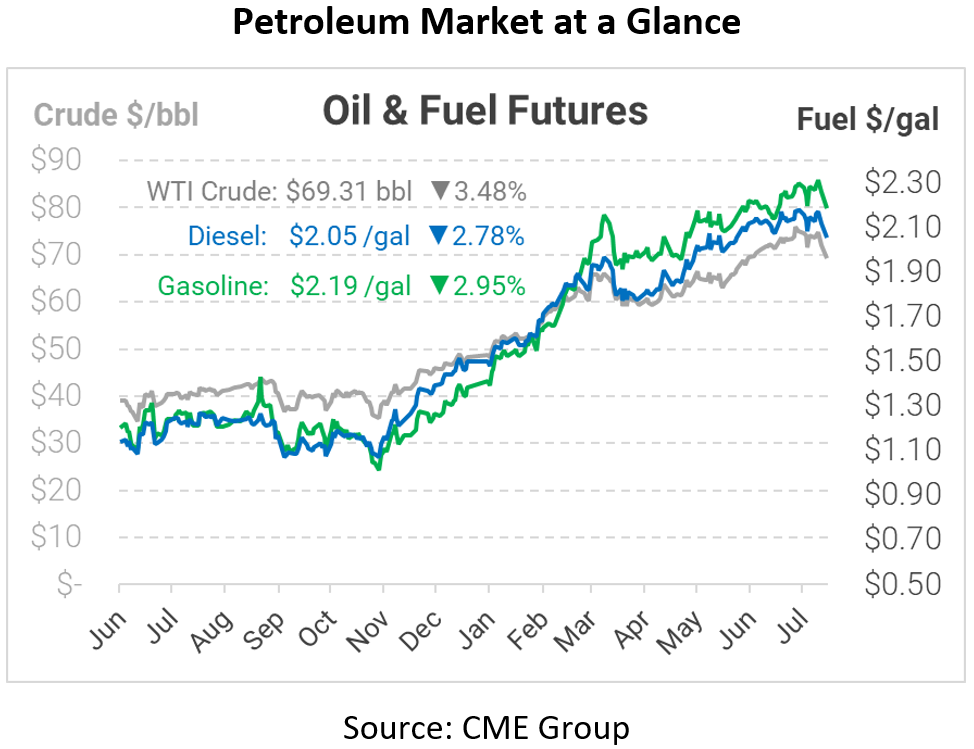

Today, the oil market enters a new week with brand new decisions being reached over the weekend by OPEC+. The group of 24 oil-producing nations and their ministers agreed on Sunday to boost oil supply starting in August, in hopes of putting a damper on oil prices that recently reached 2 ½ year highs.

This action continues unwinding efforts the same group took only one year ago when they slashed production by some 10+ million bpd (barrels per day) – an all-time record production cut necessitated by pandemic demand reduction accompanied by collapsing oil prices. The group has since gone back and forth, at times keeping supplies tighter than originally agreed, and other times letting more supply to reach international markets. While OPEC+ has reinstituted some supply, it still faces a total cut of some 5.8 bpd compared to pre-pandemic levels. After two weeks of disputes between the UAE and Saudi Arabia on production levels, OPEC+ finds itself again loosening production, agreeing on Sunday via virtual meeting to increase supply by an additional two million bpd (400 kbpd each month) from August through the end of 2022.

Also lurking in the background is the possibility of Iranian production returning to the market once Western nuclear sanctions are resolved. This could add as much as 1.5 million bpd, and OPEC+ signaled this weekend that it would adjust policy if and when this occurs. With the decision made by OPEC+ to increase production, oil markets and prices are already seeing drastic changes, with today’s opening price down almost $3.00. Today crude opened at $71.49, but since then prices have crashed below the $70/bbl threshold. Diesel opened today at $2.1011 and gasoline at $2.2416.

This article is part of Daily Market News & Insights

Tagged: Iran, Oil Supply, opec

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.