The Oil Price Surge Is Far from Over

This week the news was populated by reports of rising oil prices that have not been seen in over seven years. This trend is continuing for other forms of energy, as coal, natural gas, and other energy commodities are trading at all-time highs. Experts believe that this surge is far from over, and even a $200 price for oil is possible in the future.

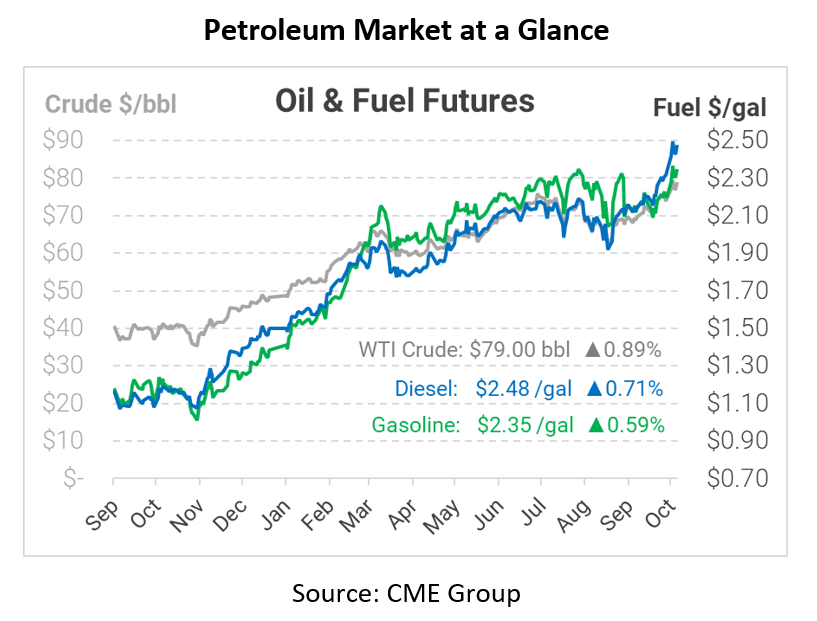

Many of the current issues that we have been seeing stem from a combination of factors. The energy market is currently surrounded by the move towards “green” energy. Combine this with constant supply chain issues as the world is recovering from a pandemic, political tensions with OPEC+, and you get extremely volatile oil prices. This week OPEC+ released that they would be sticking to their original plan of 400,000 bpd of output until April of 2022. With the news of this announcement, it is clear that the oil cartel’s continued production output policy will be the primary driver for influencing oil prices for the foreseeable future. While it is important to note that speculation is the primary driver of what oil prices will do in the future, there is still a possibility we will see the highest oil prices we have ever seen as we move along this year. Prices alone this year have risen from around $48 per barrel to around $77 per barrel.

In other news this week, we saw the PPL shut down main lines on Monday after officials discovered what appeared to be fuel-contaminated water in Alabama. The leak was quickly isolated by PPL and they were able to secure the spot and begin active cleanup. As we mentioned early, we also learned this week that oil prices reached a new seven-year high. Lastly, on Wednesday we learned about the consideration of the Biden Administration to lower renewable fuel requirements that have been set by the EPA, a move that would benefit oil refiners.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.