The Fed Holds Rates Steady

On Wednesday, WTI Crude closed slightly higher. Crude stocks had a large surprise draw of 10.6 MMbbls, which helped to lift markets. Also lifting markets yesterday was news from the Fed. Crude is down in early trading this morning as demand worries once again overshadow positive news.

As expected on Wednesday, the Federal Reserve held interest rates steady. The central bank kept rates near zero as they have been since March 15. Rates have not changed since the early days of the pandemic, and the Fed continues to pledge to support the economy as this pandemic continues. “We are committed to using our full range of tools to support our economy in this challenging environment,” Fed Chairman Jerome Powell said. The announcement had little effect on markets as they had already priced in this action – US equities held onto gains won before the Fed announcement.

The EIA reported a surprise decrease for crude of 10.6 MMbbls, versus an expected increase of 3.6 MMbbls. The large draw can be attributed to several factors. Refinery utilization was up with gross inputs above 15 MMbpd for the first time since March 27. Increased demand for products soaked up much of the increased output as the product builds last week were modest. Finally, a sharp decline in imports to the Gulf Coast by about 565 Kbpd helped to shift the flow of crude inventories.

At Cushing, the EIA reported that stocks rose by 1.3 MMbbls. US crude oil inventories are about 17% above the five-year average for this time of year. Distillates reported a surprise build and continue to trend roughly 26% above the five-year average. Gasoline also reported a surprise build in stocks and is about 8% above the five-year average.

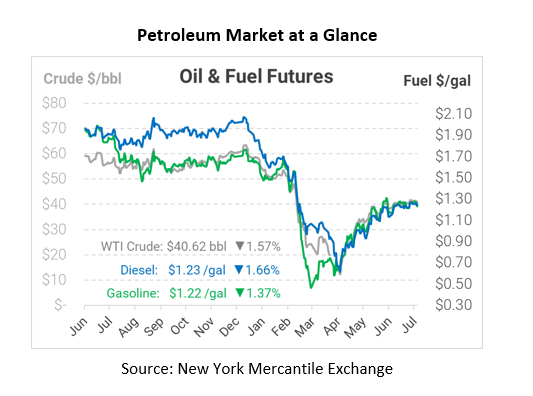

Crude prices are down this morning. WTI Crude is trading at $40.62, a loss of 65 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.2325, a loss of 2.1 cents. Gasoline is trading at $1.2245, a loss of 1.7 cents.

This article is part of Daily Market News & Insights

Tagged: eia, Fed, interest rates, Jerome Powell

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.