The (Eroding) Line in the Sand for Oil Prices

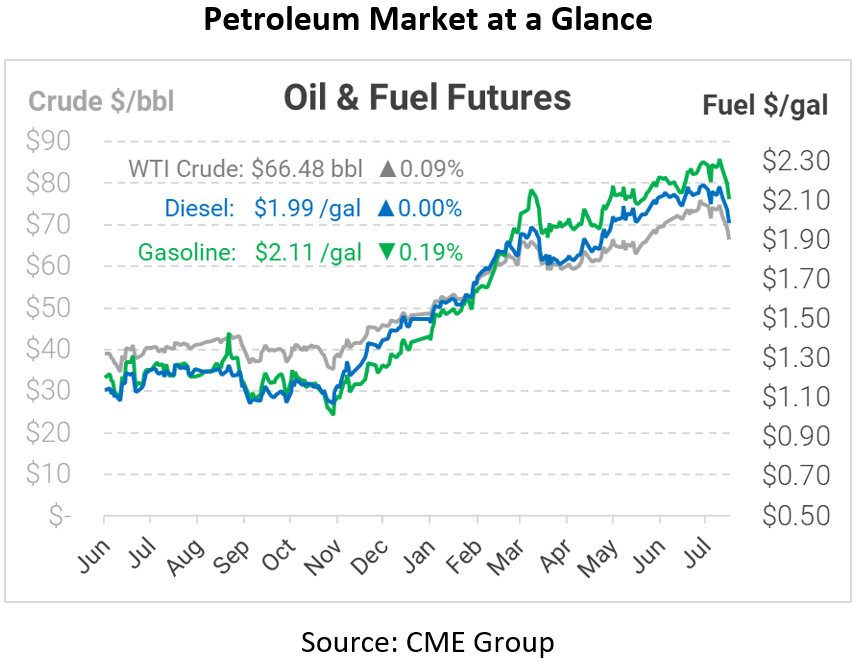

On Monday, we saw the most significant single-day drop in oil prices in 10 months. Many analysts suggest this has to do with the fear that new coronavirus variants will again bring a pause to travel, in turn heavily impacting fuel demand. Today prices fell again, with crude opening at $66.60. This was the lowest opening price since June 1. Diesel and gasoline also fell, opening at $1.9853 and $2.1156, respectively.

July ushered in new volatility for WTI crude oil. However, as we reported in yesterday’s FUELSNews, OPEC+ exited the weekend with a new production plan in hand for the remainder of 2021 – this may quell the price volatility that we have seen over the past two weeks. As a backdrop, there is also increasing concern about the potential impact on oil demand from rising COVID-19 cases caused by the Delta variant. New mask mandates (yes, you read that right) are now appearing in the U.S. – most recently in L.A. County. Asia and Pacific countries are also driving new restrictions and stay-at-home orders, a reminder that the pandemic is far from over. Such moves, if expanded, could have other chilling effects on economic recovery around the globe and place downward pressure on prices.

Already, WTI crude prices have fallen from six-year highs of $76+ to most recently today’s opening low of $66.60. As reported by several technical analyses, oil prices had been hovering around the $70 psychological level, a price considered by analysts as a reliable short-term floor. Bullish traders hope to push prices back to this range, which could support the bulls gaining more market control and demonstrate the case for higher prices later this year. On the other hand, the bearish scenario suggests that prices could indeed slide even further below the $70 mark that we saw today, creating downward momentum towards the $60 level. We will see if a new line in the sand is formed over the next several days – oil prices may continue to surprise us.

This article is part of Daily Market News & Insights

Tagged: COVID, crude, Delta, diesel, Price Drop

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.