Texas Crude Bottlenecks Could Boost Prices This Year

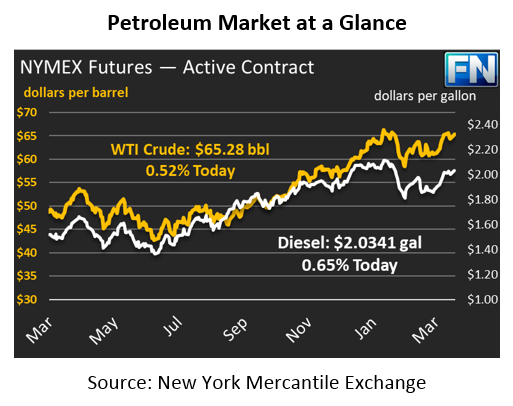

The long holiday weekend brought very little change in pricing, with crude oil gaining just 25 cents on Thursday. Prices have been trending along the path of least resistance, which currently is pointing to higher prices. Friday’s rig count data from Baker Hughes showed U.S. rigs down by 2, while Canada saw 27 rigs go offline (a 17% drop). While not a direct indicator of declining production, the news does help sustain the oil rally in the absence of more definitive news. Crude prices are trading at $65.28 this morning, a gain of 34 cents (0.5%) since Thursday’s close.

Fuel prices are also in the green this morning, after almost a penny of gains from diesel prices and small gasoline price increases. This week, fuel prices are continuing their rally. Diesel prices are currently at $2.0341, gaining 1.3 cents (0.7%) since Thursday. Gasoline prices are $2.0270, up 0.6 cents (0.3%).

IEA Reports Texas Pipeline Capacity Bottlenecks

The IEA released an analysis last week noting that U.S. pipeline capacity may fall short of production, leaving some supply temporarily stranded in West Texas in 2018 and 2019. While new projects are underway to relieve the bottleneck, many projects will not be completed until mid-2019. In the meantime, U.S. producers continue to ramp up production whenever profitable.

By the middle of this year, it’s possible that as much as 300 kbpd of oil may be stranded in West Texas – limiting the impacts of rising U.S. production. With markets very nearly balanced, it’s important that the oil being produced be able to reach the market. Forecasts of supply and demand assume that production can be used to meet demand; if it’s kept off the market, it could create a supply shortage that drives prices higher.

Trump’s tariffs on steel and aluminum, the components needed to build crude pipelines, have not been helpful. Since the U.S.’s domestic steel industry is mainly devoted to supporting the auto industry, pipeline companies rely on imports. Tariffs on steel could cause delays and budget overages, limiting how quickly new pipelines can be brought online. Slow pipeline construction would exacerbate capacity limitations, further contributing to higher oil prices.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.