Tariffs and Dorian Weigh on Oil Prices

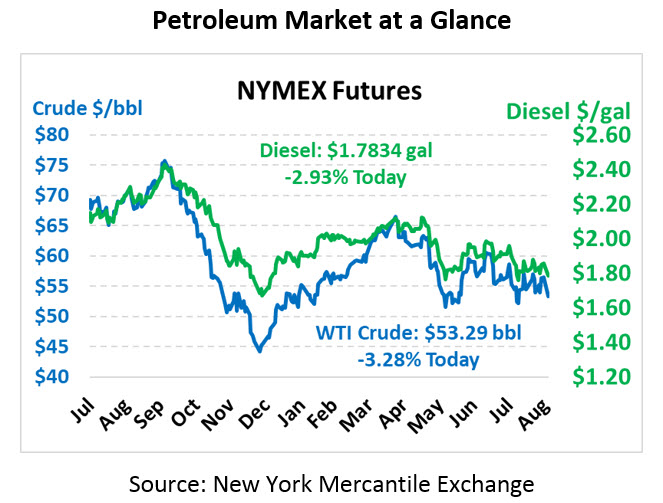

After a strong drop in oil prices last Friday, the oil complex remains weak following the long holiday weekend. With Dorian’s track now well away from any Gulf Coast oil wells, there seems to be little risk of a production shut-in. Crude oil this morning is trading at $53.29, down a hefty $1.81 (-3.3%) from Friday’s close.

Fuel prices are also sharply lower. Diesel prices are trading at $1.7834, shedding 5.4 cents (2.9%) over the weekend. Leading this complex in losses is gasoline, which is trading at $1.4597 after giving up 7 cents (-4.6%). The switch to October’s winter gasoline blend also caused a steep drop in RBOB futures, which fell from roughly $1.70 to the $1.45 range as September futures expired.

While many eyes are on Dorian as it tracks along the Southeast Coastline, the storm is not expected to have a severe impact on oil prices, other than locally. Florida does not have significant offshore oil rigs nor refineries at risk, so Dorian is unlikely to impact America’s crude and fuel outputs. On the flip side, Florida is a relatively large fuel consumer. But while Florida has a large population, hurricanes tend to cause demand to fall just 20% for gasoline and 10% for diesel, according to Platts. Platts estimated a short-term demand drop of 133 kbpd of gasoline and 16 kbpd for diesel – hardly enough to move the national needle. Locally, the storm will temporarily prevent barge transports of fuel, so Florida may see some supply imbalances in the short-term.

A big driver of lower prices this week is the implementation of tariffs by the US and China. Announced weeks ago, markets had priced in a small risk that negotiations would avert tariff escalation; that hope is now gone. With hefty tariffs now in place for nearly all goods exchanged between the US and China, expect to see the slowdown show up in economic data over the next few months.

The other major news from last week was Russia’s production, which last month hit its highest level since March. The high production exceeded Russia’s OPEC quotas, but Russia contends that over-compliance in other months justifies the high August levels. The country claims they will “fully comply” with the OPEC agreement in September.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.