Vaccine Hope Shifts Forward Prices Higher

Markets are trading sideways this morning, though remain elevated overall for the week. Markets are wrestling with two conflicting stories – short-term lockdown concerns and long-term hope for a rapid vaccine deployment.

The crude oil forward curve, which shows the trading price of crude for each month over the next several years, has narrowed significantly since the vaccine was announced, even while shifting upward. The day before Pfizer announced its 90% effective vaccine, January 2021 crude prices were just $37.50; today, they are roughly $4.50 higher. On the back end of 2021, though, December prices are only slightly higher. That suggests markets have always been optimistic about the long-term hopes of demand recovery, but only recently have had hope that balance may come early next year.

The critical question now is how fast the vaccines can be manufactured and distributed. Companies are applying for emergency FDA authorization to begin usage in the US, a process to be replicated in most developed countries. Several of the vaccines under development require sub-zero conditions during transporation, which will stretch the global medical supply chain to its limit. While a vaccine could become available within the next few weeks/months, it likely will not be widely available until well into 2021. For fuel markets, that means typical demand won’t return for several more months. Until then, markets are relying on the optimism of future success to keep current prices elevated.

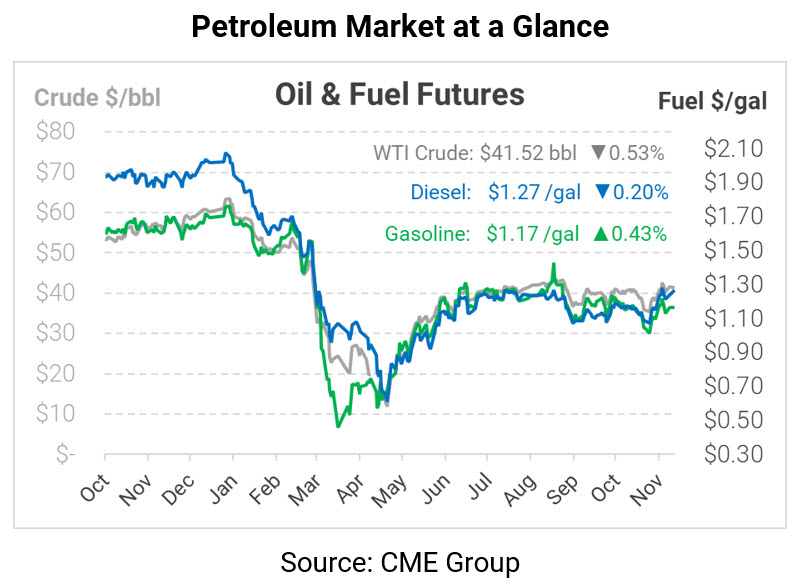

Crude oil is falling mildly this morning as the market takes a breather from this week’s rally. WTI crude is trading at $41.52, down 22 cents from Thursday’s closing price.

Fuel prices are mixed. Diesel, coming off a week of strong gains, is trading at $1.2682, down 0.3 cents from Thursday’s close. Gasoline is bucking the trend and moving higher, trading at $1.1675 with 0.5 cent gains.

This article is part of Daily Market News & Insights

Tagged: COVID-19, forward curve, vaccine

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.