US Added Rigs in June – Will Crude Production Resume?

Yesterday, WTI crude followed US equities higher in the morning session, then lower in the afternoon on coronavirus fears, ultimately closing the day about $1/bbl down. Headlines regarding renewed lockdowns and restrictions in the US and Asia surfaced in the afternoon and put downward pressure on markets. Concerns that a surge in coronavirus cases could affect the recovery at the same time that OPEC+ is considering bringing production back online have markets worried about inventories rising once again. Prices are lower in early trading this morning as supply and demand concerns persist.

Monday’s Drilling Productivity Report showed the US added wells in aggregate from May to June, driven almost exclusively by the Permian (+49). However, crude production is expected to continue dropping between July and August by 56 kbpd. Although production is falling, a rising rig count signals future production losses could stop or even be reversed. While changes in US crude production are most important for WTI prices, the impact this will have on OPEC’s decision-making cannot be downplayed. OPEC is less incentivized to keep production at its 9.6 MMbpd cut level if US barrels are coming back to the market. US shale would present competition to OPEC crude market share and price.

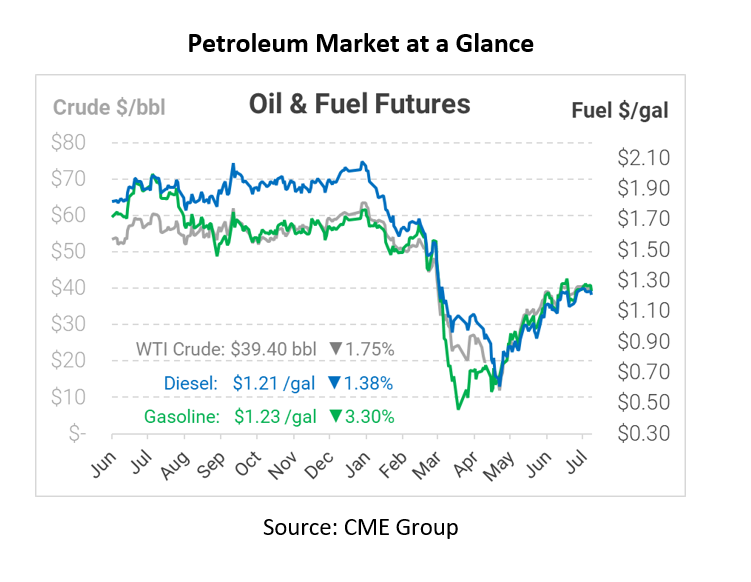

In early trading today, crude prices are down. Crude is currently trading at $39.40, a loss of 70 cents.

Fuel prices are down this morning. Diesel is trading at $1.2066, a loss of 1.7 cents. Gasoline is trading at $1.2314, a decrease of 4.2 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.