US Oil Falls One-Third amid Winter Storm

Though yesterday saw prices make a slow start, WTI crude moved higher throughout the day to close above $60/bbl for the first time since January 2020. This morning has seen the market flip flop between gains and losses as traders try to make sense of the winter storm plaguing the US.

Reportedly one-third of all American production was temporarily taken offline due to frigid weather, the largest shutdown in history. Of course, as production slows, so does demand – inches of snow and ice have kept drivers off the road in many states. This week’s EIA data will be delayed until tomorrow, and it might show some interesting trends; however, next week’s report will be the one traders watch to see how the storm has impacted supplies, inventories, and demand. Energy Aspects reports that up to 18 million barrels of US production may be kept off the market due to the storm.

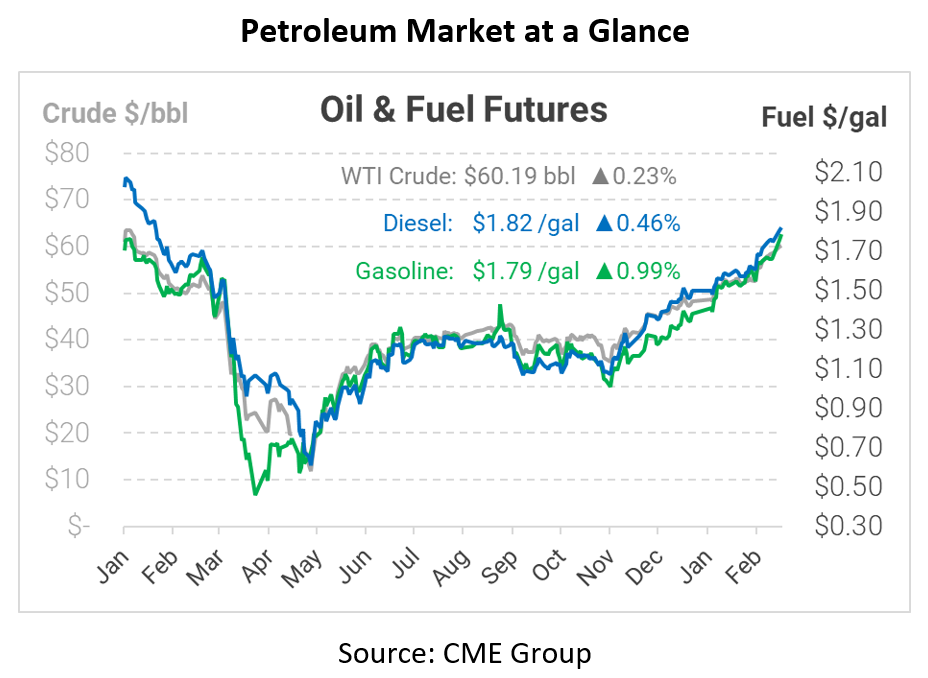

This morning, crude oil is back-and-forth, but prices are currently trading higher. WTI crude is trading at $60.19, up 14 cents from Tuesday’s closing price.

Fuel prices are also seeing a moderate lift amid refinery shutdowns. Diesel is trading at $1.8828, up 0.8 cents. Gasoline prices are $1.7905, a gain of 1.8 cents.

This article is part of Daily Market News & Insights

Tagged: Crude Production, Winter Storm

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.