US-China Trade Deal – Making Progress Despite Shortcomings

On Tuesday, WTI crude closed higher ahead of Hurricane Laura making landfall in Texas and Louisiana tomorrow morning. Crude is relatively unchanged this morning as the hurricane’s effects seem to have been largely priced into the market.

The Phase One trade deal between the US and China is moving forward as planned. On a phone call yesterday, trade negotiators agreed to continue forward progress with the deal. Concerns had been growing regarding the pace of Chinese purchases of US goods, but despite the mounting tensions on both sides, they have agreed to continue to move forward. “Both sides see progress and are committed to taking the steps necessary to ensure the success of the agreement,” the Office of the United States Trade Representative said in a statement.

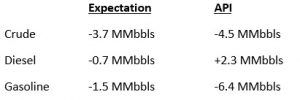

The API’s data last night:

The API reported a larger-than-expected draw for crude of 4.5 MMbbls versus an expected draw of 3.7 MMbbls. At Cushing, stocks decreased by 0.6 MMbbls. The API reported that distillates had an increase in stocks. Gasoline inventories had a large draw. The EIA will report numbers later this morning.

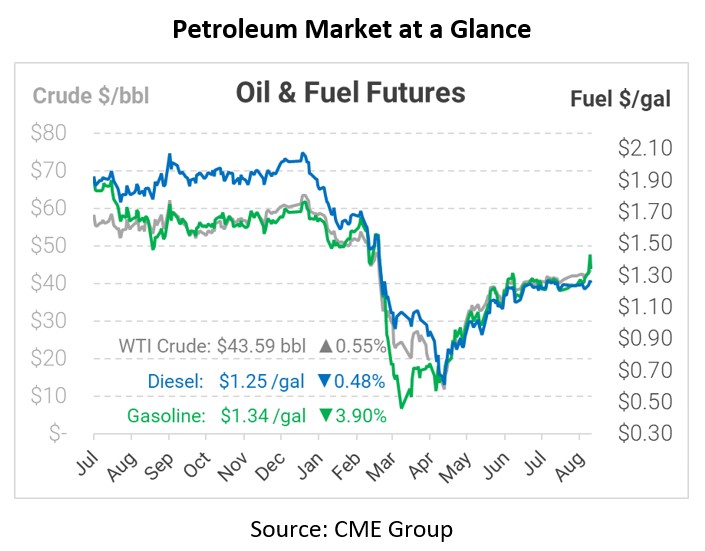

Crude prices are up this morning. WTI Crude is trading at $43.59, a gain of 24 cents.

Fuel is down in early trading this morning. Diesel is trading at $1.2540, a loss of 0.6 cents. Gasoline is trading at $1.3414, a decrease of 5.5 cents.

This article is part of Daily Market News & Insights

Tagged: China, hurricane, trade deal

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.