Turkey-Kurd Conflict Spooks Market

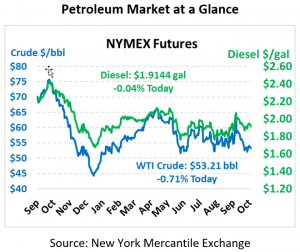

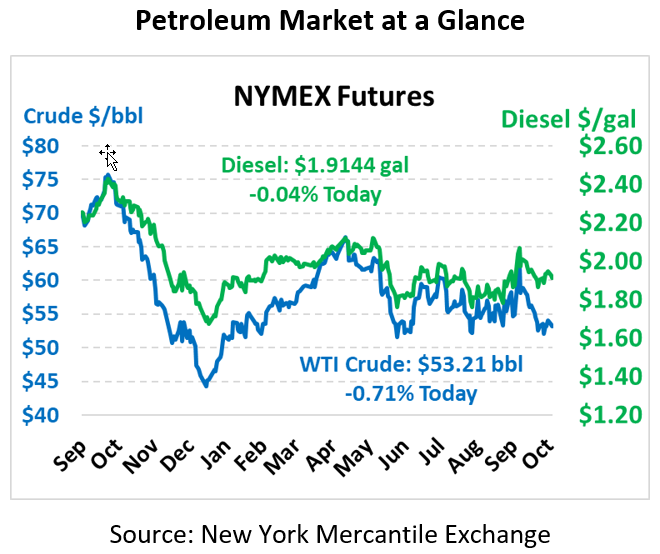

After a weak opening this morning, oil prices have turned and are moving higher in response to instability in Syria and US-Turkey relations. Falling as low as $52.40 this morning, crude prices regained some ground to trade at $53.21, still 38 cents below yesterday’s closing price.

Fuel prices are trading flat as crude markets fluctuate. Diesel traded at $1.9144, slightly below Monday’s closing price. Gasoline prices are trading at $1.6151, up a meager 20 points from yesterday.

While US-China data played a major role yesterday, the market is pushing higher following Trump’s announcement last night of tighter tariffs and sanctions on Turkey. Tariffs on Turkish steel were raised from 25% to 50%, and Trump levied sanctions on government-sponsored agencies and companies. While the impact of the sanctions won’t significantly affect oil markets, the cause of the sanctions could.

As US troops withdrew from the region, Turkey quickly launched an attack on the US-allied Kurds in Syria, forcing the Kurds to seek an alliance with Syrian President Bashar al-Assad (who, most notably, was accused of using chemical weapons on his own people a few years ago). The Kurds had teamed up with the US to fight ISIS militants and had captured over 10,000 ISIS fighters. With the Kurds fighting for survival against Turkey, the security of ISIS prisoners is now called into question. In Congress, both sides of the aisle have publicly opposed the abandonment of Kurdish allies, with some suggesting Congressional action to repeal the change.

For oil prices, neither Syria nor Turkey are major oil producers, but the conflict could draw in major producers including Iran and Russia, who support the Syrian government. The Kurds live in a territory that spans Turkey, Syria, Iraq and Iran, blurring the lines where conflict could begin and end. Even broader than that, for decades the US has moderated instability in the Middle East to protect oil flows. If the US continues withdrawing from the region and allows regional forces to take over, we may see a surge in oil market instability.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.