Trade and OPEC – What’s Suppressing Markets Today?

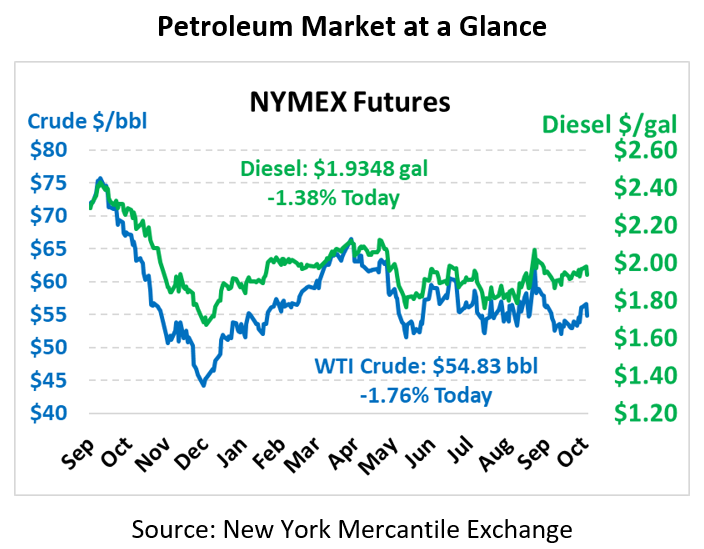

Oil prices fell yesterday following comments from Russia regarding future OPEC cuts. Still, positive sentiments on interest rates are buoying the market, providing a bit of support to cushion the drop. The Fed is expected to cut interest rates this week, lifting equity markets to near-record levels. Crude oil is currently trading at $54.83, down an additional 98 cents.

Fuel prices are slumping as well. Diesel prices are trading at $1.9348, down 2.7 cents after dropping just over a penny yesterday. Gasoline, which closed unchanged yesterday, is down 1.3 cents to trade at $1.6600.

Ironically, the cause of today’s market drop is the opposite of normal. For the past several months, OPEC has been one of the primary bull factors supporting prices, while trade has hung like an anchor around the market. Today, though, those two factors are reversed.

Russia’s Energy Minister reportedly stated that it’s too early to begin talking about deeper OPEC oil cuts. OPEC members, especially Saudi Arabia, have been hinting at the possibility of deeper cuts as global demand slows. The IEA projects a large surplus in oil markets next year if OPEC does not decrease output. Russia and Saudi Arabia are the two most influential countries pushing for OPEC cuts. If Russia chooses not to support more austere cuts, it could unravel the entire supply agreement – causing more supply and lower prices.

According to Chinese news sources, the US and China may sign “Phase 1” of a trade deal as early as November if negotiations continue running smoothly. Trump commented that a deal was running “ahead of schedule” though failed to clarify specific timing. Any boost for global trade would be a shot in the arm for financial markets which would lift equity and commodity prices alike. After weighing heavily on markets for a year, trade concerns are slowly subsiding, providing a glimmer of hope for economic activity.

This article is part of Crude

Tagged: bull factors, China, oil prices, opec, phase 1, Russia, Russia’s Energy Minister, Saudi Arabia, trade deal, US

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.