Trade Deal Details Bring Mixed Results

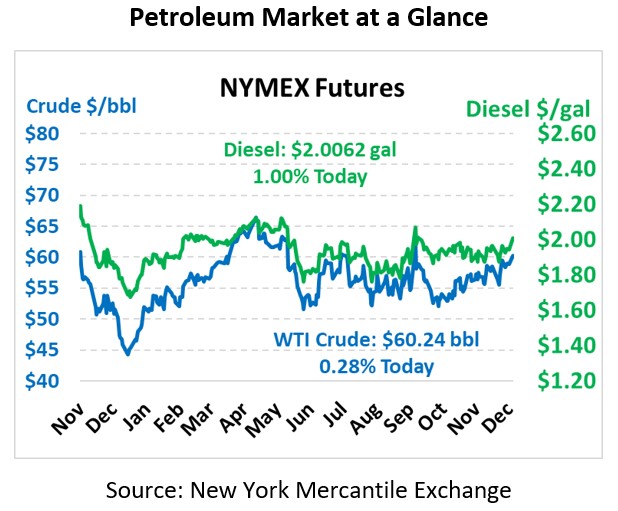

Markets surged on Friday to close just above the $60/bbl threshold last week, bringing the highest closing price since September as we inch closer to the new year. This morning crude oil is basically flat despite strength for product prices. Crude oil is trading at $60.24, up a small 17 cents

Fuel prices are generally higher today, especially for diesel prices. Diesel is trading at $2.0062, up 2.0 cents from Friday’s close and pushing for a close above $2/gal for the first time since September’s Saudi attack. Before that, diesel had been below $2/gal since May. Gasoline is trading at $1.6696, up 0.6 cents.

Markets are still watching the news for further details of the US-China Phase 1 trade deal. While the deal has passed, it’s still under legal review for both countries. Here’s what we know:

- US cancelled tariffs set to apply on Dec 15 on $160 BN in Chinese goods

- China will increase purchases of US goods and services to $2 BN for the next two years, including a large portion in agricultural goods.

- For US tariffs on $120 BN in Chinese good imposed back in September, rates will fall from 15% to 7.5%.

- US tariffs of 25% on $250 BN in Chinese goods remain in effect

- China will impose intellectual property rights reforms, though details are murky

The deal has some important contingencies, particularly regarding Chinese purchases of billions more in US goods to shrink the trade deficit. Trump has repeatedly shown his willingness to slap on higher tariffs in response to Chinese opposition, so a rollback of Phase 1 should not be ruled out. For crude markets, China’s 5% tariff on US crude imports remains, keeping oil trade flows significantly lower than years past.

In supply news, OPEC forecast a slight net draw in global crude inventories next year, in contrast to the IEA’s expectations of a net daily build. That assumes OPEC production cuts hold in place, and that economic growth projections do not change significantly from 3.0% growth in 2019 and 2020. The US-China trade deal should help to augment growth, though concerns remain regarding economic demand next year.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.