Refined Product Losses Eclipse Crude Oil Declines, Diesel Futures Lead the Drop

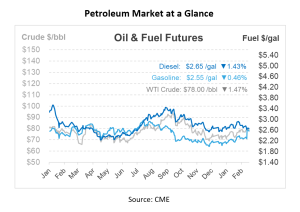

Crude futures are on the decline this morning, sitting around $78/bbl, which is down about 74 cents from yesterday. This movement extends losses from yesterday, mirroring a downturn in the broader market. Equity futures are also trading lower, while a stronger US dollar is applying additional downward pressure on crude prices. The market’s response comes in the wake of China announcing its economic objectives for 2024, setting a bold GDP growth target of 5% alongside an aim to reduce energy intensity by 2.5%. In the broader market, both WTI and Brent crude saw reductions in their pricing, $1.23 and 75c/bbl, respectively. On Monday, losses in refined products outpaced those in crude oil. Leading the decline was distillate futures, with the NYMEX April ULSD contract dropping 5.7 cents to close at $2.6472 per gallon.

China’s crude oil processing reached a new height in 2023, averaging 14.8 Mbpd, a record achievement fueled by increased refining capacity. This expansion is part of China’s strategy to meet domestic fuel demands and bolster its petrochemical industry following its recovery efforts from the COVID-19 pandemic in 2022.

On the international front, OPEC+ has announced the extension of its oil supply reductions until the end of June. The decision, aimed at preventing a global surplus and stabilizing prices, keeps the supply curbs—approximately 2 million bpd—in effect. This move was largely anticipated by the market, seen as a measure to counteract the seasonal dip in fuel consumption and the surge in production from non-OPEC+ countries, particularly US shale operators.

Saudi Arabia, responsible for half of the reduction commitment, and Russia, emphasizing cuts in production over exports, have both reiterated their support for the strategy. This cautious approach is driven by an uncertain economic forecast for China and the desire to balance global oil supply and demand dynamics.

Despite these efforts, global oil prices have remained around $80/bbl this year, influenced by both geopolitical tensions in the Middle East and a stable supply. While this price level provides some respite for consumers after years of high inflation, it poses challenges for OPEC+ members who find these prices on the lower side for their economic needs. According to the International Energy Agency in Paris, with global oil demand growth slowing and new supply from the Americas increasing, OPEC+ might find it necessary to maintain its production cuts throughout the year.

In their latest weekly oil tracker released yesterday, Goldman Sachs noted a pause in the recuperation of estimated oil flows through the Red Sea, which remain reduced by 1.8 Mbpd since the onset of disruptions on December 18, 2023. This week’s highlighted chart points to a standstill in the recovery process of estimated oil flows through the Bab-El-Mandeb Strait, proving a continued shortfall of 1.8 Mbps (or 28% based on a 14-day moving average) since disturbances began late last year.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.