Red Sea Attacks Impact Global Trade and Energy Prices

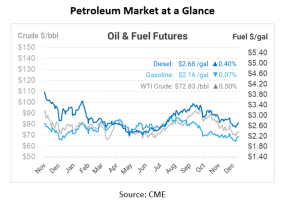

Crude oil futures have experienced a turbulent journey in recent days, influenced by a combination of geopolitical tensions in the Red Sea, production announcements from Nigeria, and Russia’s oil export cuts.

The tensions in the Red Sea, where Houthi rebels have carried out attacks on ships, raise concerns about potential disruptions to oil supply. The Red Sea is a vital shipping route for global trade, with approximately 12% of the world’s shipping traffic passing through the Suez Canal. When a Norwegian-owned vessel was attacked in the Red Sea, it prompted oil major BP to temporarily halt transits through the area, and other shipping companies followed suit.

These attacks have created a geopolitical risk premium in oil prices, contributing to a 1% increase. However, despite the spike in prices, experts believe that the actual effect on oil flows is likely to be limited. The attacks have not targeted infrastructure that would interfere with oil production.

In response to these attacks and concerns over their impact on global trade, the United States initiated a multinational operation aimed at ensuring the security of commerce in the Red Sea. Defense Secretary Austin announced the involvement of nations such as the United Kingdom, Bahrain, Canada, France, Italy, Netherlands, Norway, Seychelles, and Spain in the Red Sea security operation. The group will conduct joint patrols in the southern Red Sea and the Gulf of Aden.

While the Red Sea tensions have undoubtedly contributed to oil price volatility, it’s essential to consider the broader factors affecting the energy market. The disruption in the Red Sea is unlikely to have a significant impact on crude oil and liquefied natural gas (LNG) prices. The ability to reroute vessels in the event of disruptions suggests that production should not be directly affected.

According to estimates by experts, a prolonged redirection of all 7 million barrels per day (mb/d) of gross oil flows in the Red Sea would raise spot crude prices by $3-4 per barrel. The largest impact would be on clean and dirty tanker freight rates, with potential increases of $4 per barrel (55%) and $1 per barrel (25%), respectively, due to the inelastic supply of freight.

In contrast, a hypothetical closure of the Strait of Hormuz would have a more substantial impact on global oil prices, as there are limited alternative export outlets for crude in that region. Estimates suggest that oil prices could rise by 20% in the first month of such an interruption.

Shifting focus to Nigeria, the state-owned energy company has announced plans to increase oil production to 2 million barrels per day in 2024. To achieve this, the country aims to crack down on oil sabotage and theft, which have hampered its ability to meet its OPEC+ quota for over a year. This development could potentially add more supply to the global market, helping stabilize prices.

Meanwhile, Russia has pledged to deepen its oil export cuts in December, potentially by 50,000 barrels per day or more. This decision comes after Moscow suspended a significant portion of its Urals crude exports due to logistical issues. While these export cuts may offer some support to oil prices, skepticism remains about the extent to which Russia will implement voluntary output cuts.

In this dynamic landscape, Goldman Sachs has adjusted its price expectations for Brent crude in 2024, lowering the forecast by $10 per barrel to a range of $70 to $90. The investment bank attributes this adjustment to strong oil production in the United States, which is expected to moderate any significant upside in oil prices. Analysts anticipate U.S. Lower 48 crude output to reach 11.4 million barrels per day in the fourth quarter of the following year.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.