Oil Trade Focuses on Storm Activity

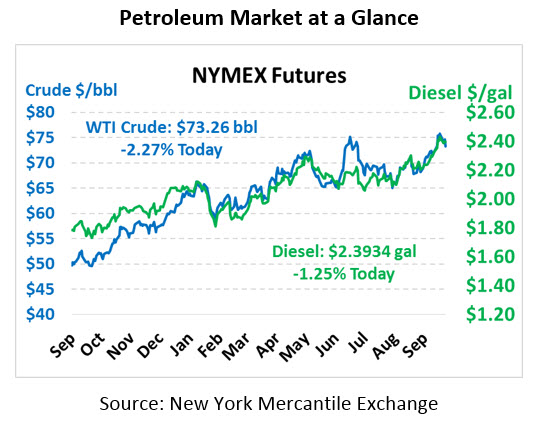

Oil prices are down this morning after closing yesterday just shy of $75/bbl. All eyes are on Hurricane Michael as the storm makes its way to land, taking Gulf Coast crude production offline in the meantime. WTI Crude is currently trading at $73.26, a decline of $1.70 this morning.

Fuel prices are also in the red today, following crude lower. Diesel prices are currently $2.3934, down 3.0 cents since yesterday’s close. Gasoline prices are trading at $2.0196, a loss of 5.8 cents.

Markets are generally unchanged this morning as traders focus on the storm approaching the US, though Iran sanctions remain in the back of mind. Indian companies are seeking waivers to purchase Iranian crude oil, though the State Department has yet to grant a waiver despite indications that exceptions would be possible. This week’s API and inventory reports are delayed due to Columbus Day, forcing markets to wait on inventories and simply track the storm.

More information on Hurricane Michael will be published in today’s FUELSNews Storm Alert.

Weekly Round-Up

S&P Global Platts: $100/b darlings of US oil could lead way for crude

Reuters: Gulf of Mexico offshore platforms evacuated ahead of hurricane

EIA: U.S. home heating bills likely to be slightly higher this winter

RBN Energy: Low Budget – Western Canadian Select Crude Topples To 10-Year Low

Fleet Owner: Anna Rosas: From fixing army tanks to diesel engines

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.