Norway Strike in Mediation, Eases Market

After a week of rallying prices, oil markets are taking a breather. Crude oil prices are pulling back slightly, and fuel prices are seen varying degrees of losses as well. The strike in Norway continues to escalate, becoming a surprisingly important global oil event. Protesters have warned that if no concessions are made on wages and working conditions, they will triple the production taken offline to just under 1 MMbpd offline, representing 25% of Norway’s oil production. Employers and labor groups are entering mediation today to come up with a solution. Norway’s government can declare an emergency and intervene, but so far, officials have noted it’s up to the two parties to reach a reconciliation.

On the demand end, an OPEC forecast now suggests that peak oil demand has already come for developed OECD countries, even if total global demand may continue rising for the next two decades. Slow population growth, engine efficiency, and shifts to alternative fuel are all pushing developed countries to cut back on fossil fuel consumption. Of course, Saudi Arabia is prepared to ride the trend all the way to the end – becoming the lowest cost producer as demand falls decades from now.

For North American fuel consumers, the report offers an important reminder. Many believe that electric vehicles will struggle competitively because lower fuel demand reduces fuel prices, making it harder to breakeven when converting to EVs. If the OPEC report is correct, other countries will pick up the slack, supporting oil prices even as OECD demand falls. At least for the next couple of decades, don’t expect electric vehicles and fuel efficiency to drive fuel prices to extreme lows.

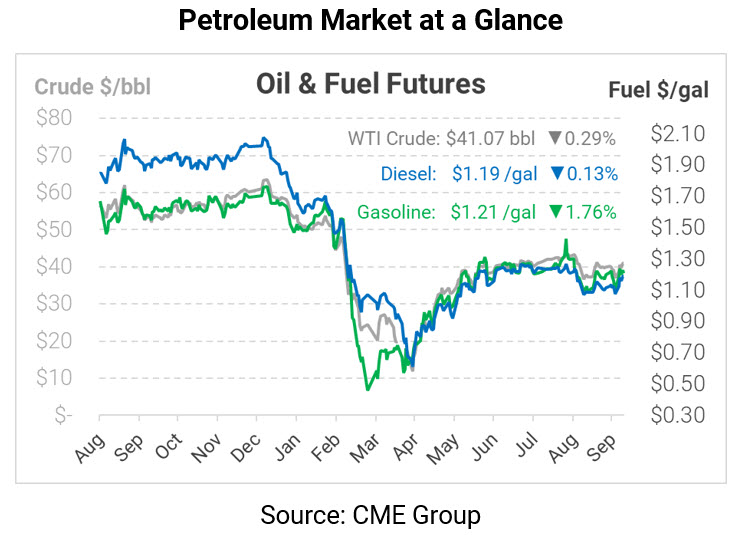

Fuel markets are taking a break this morning after a week of rallies sent WTI crude above $41/bbl yesterday. This morning, WTI crude is trading at $41.07, down 12 cents from Thursday’s close.

Fuel prices are seeing mixes losses, with gasoline leading the market lower. Gasoline is trading at $1.2099, down 2.2 cents from yesterday’s closing price. Diesel prices are roughly flat with yesterday, trading just 0.2 cents lower at $1.1908.

This article is part of Daily Market News & Insights

Tagged: Crude Production, Norway, opec, Peak Oil

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.