M&A Insights – Oil Major Announces $5B Acquisition

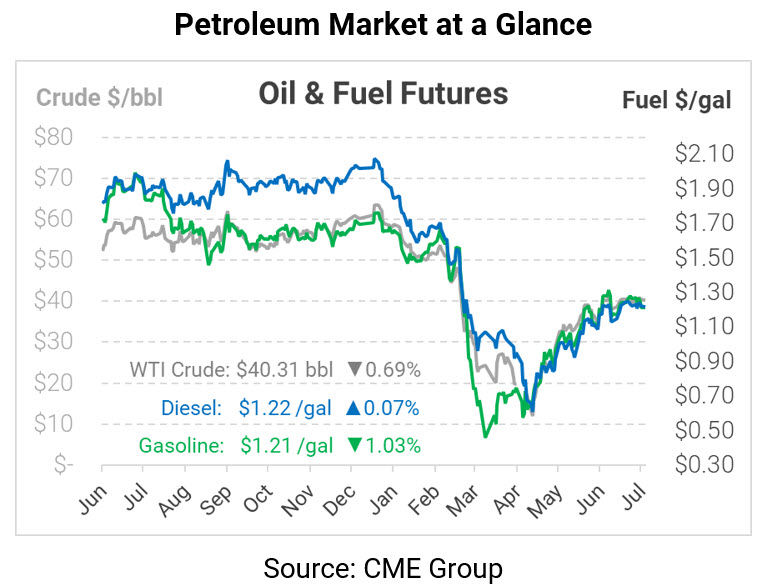

Oil markets seem to be meandering lower this morning on little fresh market news. Following historic lows in April, markets seemed to interpret the lack of news as bullish – anything was better than the detrimental events in the rearview mirror. Now that markets have recovered to more “normal” levels, it’s harder to maintain momentum. With COVID-19 cases rising, markets need supportive headlines to maintain higher prices and prevent a reversal.

While oil prices have recovered many of their losses, oil companies are still struggling. A month ago, one of the pioneering companies of the Fracking Revolution declared bankruptcy. Now, at least one oil major seems ready to begin sweeping up the wreckage.

Chevron recently announced plans to acquire Noble Energy for $5 billion, expanding Chevron’s presence in the Permian Basin and the Eastern Mediterranean. So far, M&A activity in the oil upstream has been extremely weak this year, down by roughly 60% from 2019’s robust deal-flow.

During the last market downturn, oil companies survived by merging and consolidating operating costs. The result of all those massive deals was lower oil prices, enabling US shale to remain competitive during low-price environments. In 2017-2019, consumers benefited from the expanded shale production, which kept a lid on crude prices. This go-round, oil majors seem to be prioritizing cash preservation, so it may be a while before M&A picks up.

In the short-term, consumers will enjoy the low prices that come with the oil bust. Long-term, however, these could be a double whammy for consumers:

- When oil companies practice austerity, the first cuts are to exploration and research. This keeps costs low for now, but at the cost of future production. Companies will either have to spend more in the future to catch up or cut production due to having fewer shale wells mapped. Reduced exploration now means higher prices in the future.

- As companies go bankrupt instead of being acquired, their assets become stranded in the field. With oil demand picking up, re-starting operations will be a complex process of determining new ownership, assessing equipment, and initiating start-ups. Depending on the timing, these delays could translate into reduced supply and higher pricing.

For more news on oil industry acquisitions, check out this aggregation of industry analysis. To learn about Mansfield Energy’s recent acquisition, click here.

Oil is following equity markets lower this morning. Crude oil is trading at $40.31, down 28 cents from Friday’s closing price.

Fuel prices are mixed this morning. Gasoline is leading the market lower, trading at $1.2119, down 1.3 cents (1%) below Friday’s closing price. Diesel prices are $1.2199, fractionally higher.

This article is part of COVID-19

Tagged: Acqusition, Chevron, COVID-19, M&A, Noble Energy

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.