Iraq, Libya Face Reduced Output

Despite a market run-up this morning that briefly sent fuel prices nearly 2 cents higher per gallon, the market is trading flat/lower this morning. Over the weekend, a few supply issues reared their head. Iraq is set to reduce their output to 3.6 MMbpd to offset above-quota production in 2020, taking their production to a 6-year low. With Saudi Arabia voluntarily holding 1 MMbpd off the market and Iraq seemingly reducing output, the oil complex appears unworried about the short-term risk of lockdowns and rising COVID cases. Of course, Iraq has been promising to reduce output for months, so markets will be watching closely to see if they come through with committed cuts.

Libya, which just hit a 6-year production high of 1.25 MMbpd in January, is under threat once again. A militia in eastern Libya threatened to shut three terminals amid salary payment disputes, which would be a devastating blow to normalizing supply. The country’s production has been plagued by years of instability and military coups, leading to volatile output. Last year, the country’s militia finally backed down and allowed production to resume, leading to a rapid increase in output. Now, it seems the instability may play a part again in 2021.

Rising oil prices have been supportive for US producers, and rig counts grew for the ninth consecutive week last week by 2 rigs. Still, rig activity is 52% less than levels seen a year ago, and most shale producers have committed to restraint even as prices climb higher.

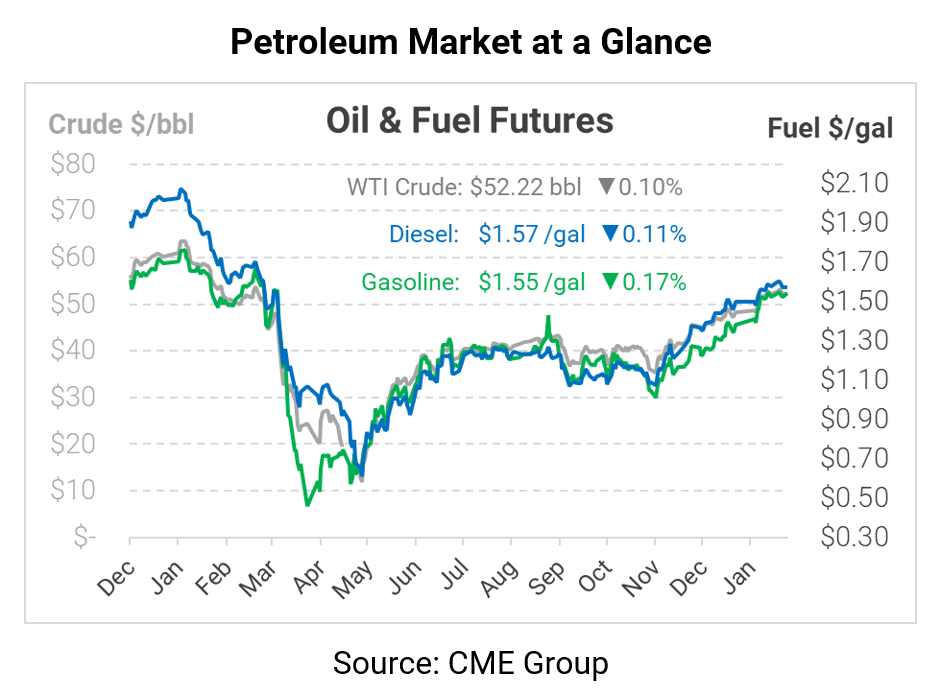

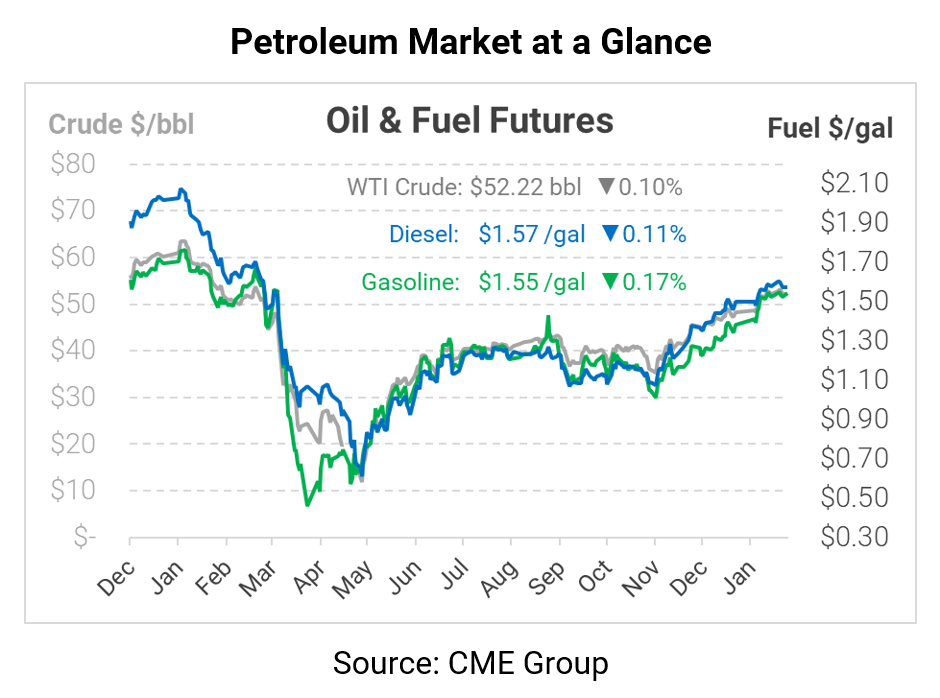

This morning, crude prices are trading flat/lower despite bullish production news. Although there’s plenty of bullish news between Middle Eastern supply cuts and stimulus legislation, those factors are largely baked in. WTI crude is trading at $52.22, down a mere 5 cents.

Fuel prices are also beginning the week with a minimal change from Friday. Diesel prices are trading at $1.5743, down 0.2 cents from Friday’s close. Gasoline is $1.5461 currently, down 0.3 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.