Inventory and OPEC News Move Markets

Yesterday, crude prices were down on the close to halt a five-day rally in the markets. The EIA reported a smaller-than-expected build in crude stocks, which seemed to be outweighed by the much larger-than-expected increase in diesel inventories. The overall build in crude and products together with tight storage capacity at Cushing and around the world caused pause among traders yesterday as the markets pared back the gains from the previous five days. Crude is up in early trading this morning.

Saudi Arabia raised its price for June light crude in Asian markets. While it is still selling at a good discount to some benchmarks, the price increase runs counter to market expectations. Asian refiners were expecting Saudi Arabia to lower the prices of its crude for a fourth straight month in June after Middle East benchmarks slumped on poor refining margins as the coronavirus pandemic decreased demand. This action seems to be helping lift markets this morning.

Iraq, OPEC’s second-largest producer and the biggest cheater in previous production cut deals faces difficulties in the new OPEC+ deal as well. As part of the OPEC+ deal, Iraq needs to cut around 1 million bpd of its production. Iraq has yet to agree on how the cuts should be divided among the many major Iraqi oilfields, most of which are operated by international majors. Further complicating matters is Iraq’s inability to form a new government to make decisions regarding oil supply and reductions.

U.S. crude inventories were up for a 15th straight week last week. The EIA reported a smaller-than-expected rise for crude of 4.6 MMbbls, versus an expected increase of 7.8 MMbbls. At Cushing, the EIA reported that stocks rose by 2.1 MMbbls. Distillates reported a larger-than-expected build and are about 12% above the five-year average for this time of year. Gasoline reported an inventory draw. Gasoline inventories are about 9% above the five-year average for this time of year.

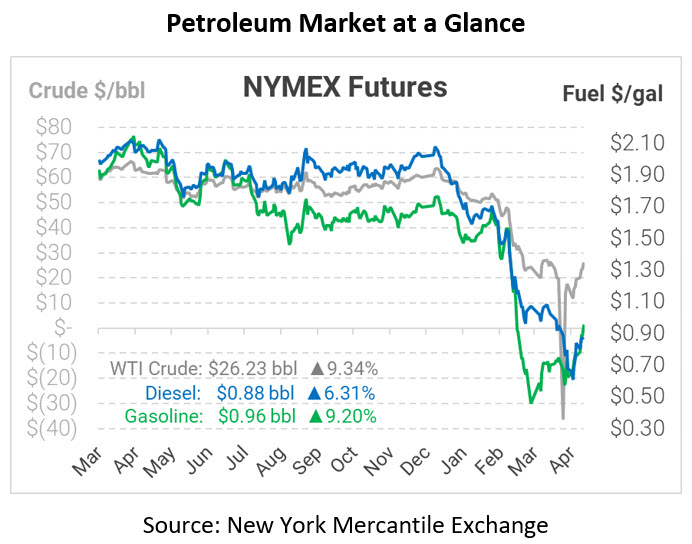

WTI Crude is trading higher this morning at $26.23, a gain of $2.24.

Fuel is up in early trading this morning. Diesel is trading at $0.8760, a gain of 5.2 cents. Gasoline is trading at $0.9576, a gain of 8.1 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.