Imports Hit Decade Low, US Net Exporter Last Week

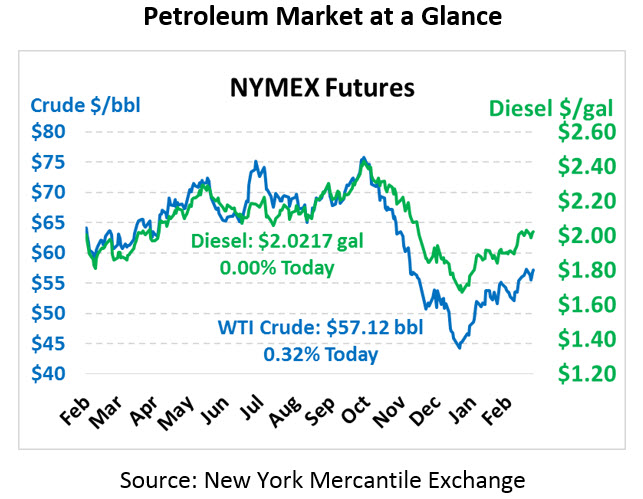

Crude oil soared yesterday, carrying fuel prices with it as it posted almost $1.50/bbl gains. This morning, prices are recouping from yesterday’s rally, with oil prices trading roughly flat at $57.12

Fuel prices are also recovering from yesterday’s gains. Diesel is flat to yesterday’s price, trading at $2.0217. Gasoline has edged a bit higher, trading at $1.6405 with 0.7 cent gains.

The march higher brought oil prices back to virtually the same level they began the week, before Monday’s huge sell-off. Yesterday’s EIA report spurred hefty gains as crude posted a very large, counter-seasonal inventory draw. Gasoline and diesel stocks also both fell, though they were hardly the headline. Of course, Cushing inventories (the delivery point for WTI crude) did rise, which helped keep a lid on upward movements.

Perhaps the biggest takeaway from the data was the steep decline in imports, accompanied by another week of strong exports. In fact, this week was one of the rare times when total petroleum exports exceeded total imports, though the EIA expects that to become more common in the years ahead.

Imports fell to their lowest level in over a decade, hitting their lowest weekly level since Feb 1996. Was this the effect of Venezuela sanctions? Partially, though by no means was the decline entirely driven by Venezuela. Canadian imports fell to the lowest level since January 2018, almost 500 kbpd below the two-month average level. Saudi imports in Q1 2019 have been over 300 kbpd lower than they were in Q4 2018, a result of their decision to cut output. Venezuela, on the other hand, is just 100 kbpd lower quarter-over-quarter, though imports from Venezuela did fall 350 kbpd from last week.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.