IMO 2020 Hits, Diesel Prices Steady

For all the talk about IMO 2020, markets seem to be adapting quite well to the massive change which affects roughly 4% of the world’s oil demand. The regulation officially went into effect yesterday, requiring that all marine vessels switch from using 3.5% sulfur fuel to 0.5% sulfur fuel.

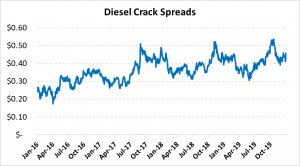

While marine fuel prices have seen some fluctuations, diesel crack spreads (the difference between a gallon of diesel and a gallon of crude oil) tracked normal seasonal levels, though with a slightly bullish bias. Early in 2019, the EIA forecasted that crack spreads would average $.65 cents in 2020, a large increase from current levels.

Why haven’t we seen the price shocks forecast by the EIA and most other major organizations?

For starters, refiners started early to get ahead of the new demand, growing inventories in major ports around the world in anticipation of the Jan 1 startup. Part of the speculation on IMO 2020 was around the chicken-and-egg problem of refiners not knowing what approach shippers would take, and shippers not know what refiners would price. Refiners stepped up and got ahead of these problems in many markets, though some areas may see higher marine shipping rates because of limited fuel supplies.

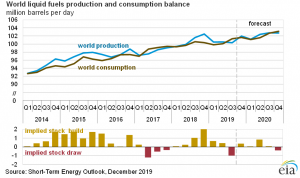

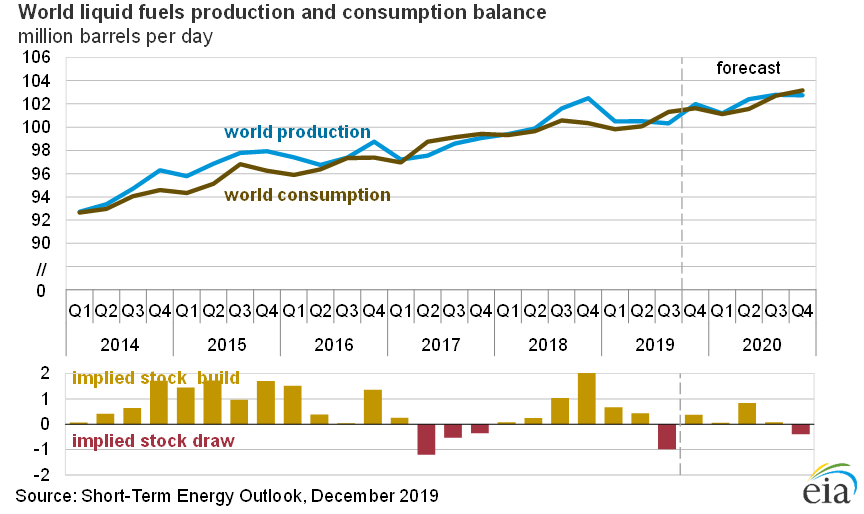

Global markets are also awash with crude oil right now, keeping overall prices low. The EIA’s most recent oil market forecast points to rising inventories in 2020, despite hefty declines in Q3 2019. With plenty of crude oil to keep markets supplied, traders aren’t too worried about the ability to create diesel, marine fuels and other necessary products.

Finally, the economy plays a major part in limiting marine and diesel demand, keeping spreads for both products in check. A survey of major oil publications in 2019 such as the IEA’s Oil Market Report, OPEC’s Monthly Oil Market Report, and the EIA’s Short-Term Energy Outlook reveals a steady decline in oil demand projections for 2020. As the year went on, lofty expectations for demand fell due to gloomy economic prospects, while supplies from the US and other countries kept rising. This imbalance has kept the bulls at bay, lowering price outlooks for all oil markets including diesel, gasoline, and marine fuels among others.

Other Threats on the Horizon

While IMO 2020 came with a whimper rather than a bang, on-land fleets cannot simply let down their guard. Since December 1, diesel prices have gone up almost 20 cents, and the market is up 30 cents from August 2019 lows. Diesel prices have remained stubbornly above $2/gal since mid-December, and so far there have been no signs of reversion.

Diesel prices can be affected by any number of factors. Positive developments in US-China trade have lifted the entire market, putting pressure on fuel budgets. US diesel inventories are still quite low, so prices could easily climb higher if marine fuels suddenly fall short or a cold winter snap causes excessive heating oil demand. While IMO 2020 may not have brought massive market volatility, other factors still may trigger unstable prices in the new year.

This article is part of Crude

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.