IEA: 4 Oil Trends to Watch for August

The IEA released their Monthly Oil Report for August, which is packed full of headline-worthy news items. Today’s article will unpack some of the key themes:

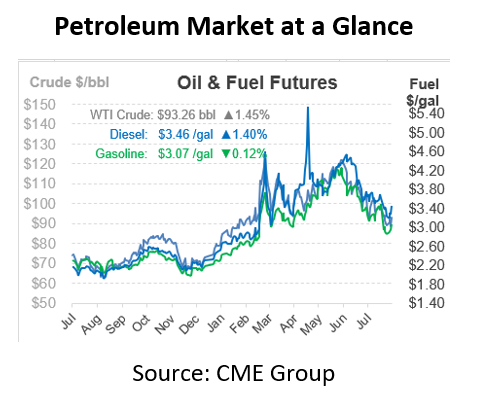

- Bullish: Fuel switching is driving “soaring” oil demand for power. As natural gas prices rise and heat waves drive power consumption, more power companies are considering heating oil for electricity. This trend led the IEA to increase their 2022 oil demand estimate by 380 kbpd. Fun Fact: That’s roughly the equivalent of Oklahoma’s entire production capacity last year.

- Bearish: Global supplies hit a post-COVID high, climbing to 100.5 MMbpd thanks to maintenance ending in Europe, Canada, and Kazakhstan. The agency expects supply to continue rising to 101.5 MMbpd by the end of the year.

- Bearish: Russia is producing more oil than projected despite sanctions. Although western countries and their close allies have cut Russian purchases by 2.2 MMbpd, three-quarters of that has been re-routed to China, India, Turkey and others. By February 2023, the IEA expects another 2.3 MMbpd to stop flowing westward, either hitting the open market or staying in Russia.

- Bullish: OPEC+ lacks the capacity to increase production further. The 100 kbpd increase for September was considered “largely symbolic” since the group remains 2.75 MMbpd behind existing quotas.

This article is part of Daily Market News & Insights

Tagged: crude, crude prices, Daily Market News & Insights, demand, diesel, gasoline, IEA

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.