Hurricane Delta Closing Down Production

On Wednesday, WTI crude closed near the $40 mark on the hopes of a narrow stimulus deal being passed as had been proposed by President Trump. While negotiations have stalled for a large, broad stimulus package, the hope is that a small targeted deal could be passed before the election. Crude is up in early trading this morning.

Hurricane Delta is moving through the Gulf of Mexico, on track to hit Louisiana on Friday. Nearly 1.5 MMbpd, or 80% of oil output in the Gulf, has been shut in preparation for the storm, and markets are reacting bullishly to the temporarily shut production. The area is still recovering from recent storms, and Hurricane Delta will cause refineries in the area to close once again. While prices are up this morning, crude prices will likely fall later on as refineries slow their crude purchases in the affected areas.

The EIA reported a build for crude of 0.5 MMbbls, versus an expected increase of 0.3 MMbbls. At Cushing, the EIA reported that stocks increased by 0.5 MMbbls. US crude oil inventories are about 12% above the five-year average for this time of year. Refineries operated at 77.1% of their operable capacity last week, but this number will likely be lower in next week’s report due to Hurricane Delta. Distillates reported a draw and continue to trend roughly 23% above the five-year average. Gasoline inventories had a decrease and are about even with the five-year average.

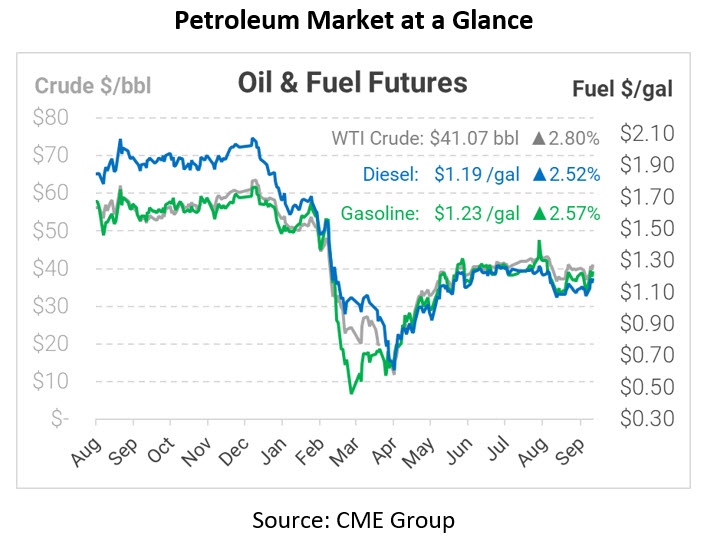

Crude prices are up this morning. WTI Crude is trading at $41.07, a gain of $1.12.

Fuel is up in early trading this morning. Diesel is trading at $1.1901, a gain of 2.9 cents. Gasoline is trading at $1.2318, an increase of 3.1 cents.

This article is part of Daily Market News & Insights

Tagged: eia, hurricane, production, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.