Goldman Sachs’ 2024 Outlook for Brent Crude

In an era where the word ‘volatility’ has almost become synonymous with the global oil markets, Goldman Sachs’ latest research note offers a rare glimpse into a future marked by tranquility rather than tumult. The commodities team at Goldman Sachs forecasts steadiness in Brent crude prices for the year 2024, with anticipated fluctuations being some of the most subdued we’ve seen recently.

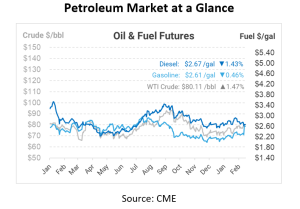

Goldman Sachs predicts that Brent crude will hover within a $70-$90 per barrel range throughout 2024, a forecast that spells a period of unusual calm for a commodity known for its unpredictability. This can be attributed to what the bank describes as a near-perfect equilibrium between supply and demand dynamics in the global market.

Despite the expectation of low volatility, the bank has made a minor adjustment to its summer forecast for Brent, raising the target by $2 to $87 per barrel. This adjustment is linked to quicker-than-expected drawdowns of The OECD stockpiles and a reshuffling of oil flows, primarily due to disruptions in the Red Sea. Nonetheless, the bank maintains its 2025 price target for Brent at $80 per barrel, underscoring its belief in sustained market balance.

The Forces Behind the Forecast

Goldman Sachs identifies three key drivers underpinning its predictions for the oil market in 2024:

- Modest Geopolitical Risk Premium: The analysts have incorporated a geopolitical risk premium of merely $2 per barrel into their forecast. This modest figure is supported by higher stock levels at sea, which provide a buffer against shipping disruptions.

- OPEC+ and Spare Capacity: The report highlights the elevated spare capacity within OPEC+, suggesting that the cartel is well-positioned to manage potential supply shocks. Furthermore, the decision by Saudi Arabia to maintain its maximum sustainable capacity at 13 million barrels per day is seen as a commitment to market stability. The consolidation within US shale and the measured growth targets of large producers further contribute to this steadiness.

- Tight Supply-Demand Balance: The global oil market is expected to achieve a delicate balance, with demand growth closely matched by non-OPEC (excluding Russia) supply increases. While there are adjustments in growth estimates for various regions, the overall picture is one of tight alignment between supply and demand.

Looking Ahead: Potential Risks and Adjustments

Despite the overarching theme of stability, Goldman Sachs acknowledges potential risks that could sway the market. Disruptions in the Strait of Hormuz or significant cuts to Iranian supply could introduce upward pressure on prices. Conversely, an extension of OPEC+ cuts could lead to a further tightening of the market. In such scenarios, the bank posits that Brent could climb an additional $7 per barrel.

West Texas Intermediate (WTI) prices are expected to trail Brent by approximately $5 per barrel, maintaining a consistent differential through 2025.

Goldman Sachs’ forecast offers a vision of relative serenity in the seas of the oil market. This prediction of low-price volatility and a balanced market in 2024 provides a break from the unpredictability that has characterized recent years.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.