Gas Pump Prices – What to Expect In 2022

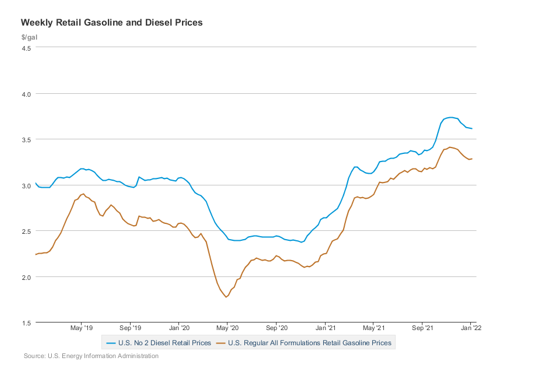

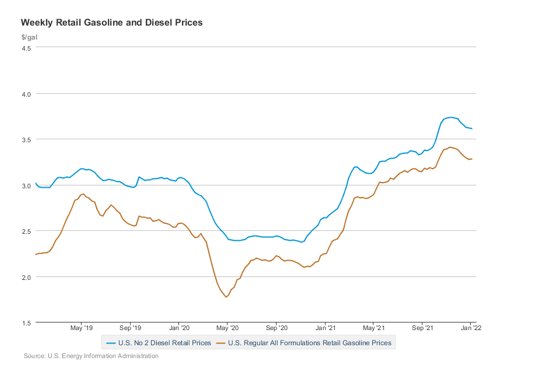

Over the past few months, we have been accustomed to higher prices when filling up our cars. In some areas, gasoline was over $4 per gallon, contributing to a seven-year high for consumer oil prices at the pump. Over the past year as the cost of crude rose, so too did prices at retail gas stations. The average price in 2021 was $3.36 a gallon compared to the beginning of the year where it was $2.19. Last year saw prices rise to numbers not seen in some time, but unfortunately it seems like higher prices are not over just yet.

For the first half of 2022, higher gasoline prices are expected to remain for much of the continental United States. These prices are expected to remain high because of one thing – the high price of crude oil. In the first week of January, crude oil briefly passed the $80 mark. Add the high price of crude oil to lingering supply and demand issues, and it is easy to see how prices will not change dramatically. COVID-19 will not help these prices either, as it seems a new variant is discovered almost every month that causes severe market disruption. So now that we know what the current state of the market is, what should we be expecting for 2022?

According to the U.S. Energy Information Administration (EIA), expect crude oil prices to hover around the $70 mark for 2022. In 2021 they averaged $71, so their close estimate means we could be in for another similar year in terms of what we will be paying at the pump. While they expect the average price of gasoline to drop to around $2.88 in 2022, others such as Bank of America, Wells Fargo, and Goldman Sachs believe that oil will not drop, but push upwards in 2022. Over the coming months we will have a better idea of what we can expect to see as the new trends for pricing in 2022, but for the time being don’t get your hopes up about the possibility of paying $2.50 for a gallon of gas.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.