Federal Reserve Makes a Surprise Cut

Yesterday, crude ended higher, but felt pressure from falling equities. Losses were contained by rumours of OPEC+ output cuts and the Federal Reserve cutting interest rates. This morning markets continue to be buoyed by OPEC+ news and rumours of deeper supply cuts to offset the slump in demand caused by the coronavirus. According to Reuters, Saudi Arabia and a technical panel of several representatives from OPEC states recommended OPEC+ to cut output by as much as an extra 1 mmbpd during the second quarter only.

The Federal Reserve made a surprise cut between meetings yesterday. The purpose was to help boost markets in the face of the coronavirus losses we have experienced this year. This 50-basis point rate cut had the opposite effect on equites yesterday as the market read the cut as more of a warning that things were going to get worse. The 50 Basis point cut was the largest since the 2008 recession. Equities seem to be recovering somewhat in early trading this morning.

In retail news, prices at the pump didn’t keep up with the rapid and steep decreases seen in futures and spot markets, producing wide rack-to-retail spreads in all regions throughout the country. While wholesale prices have dropped dramatically this year so far, consumers and business using retail fleet cards are only seeing a fraction of those savings at the pump.

The API’s data last night:

The API reported a smaller-than-expected build for crude of 1.7 MMbbls versus an expected build of 2.6 MMbbls. At Cushing, stocks fell with a draw of 1.4 MMbbls. The API reported distillates had a smaller-than-expected draw and gasoline had a larger-than-expected draw. The EIA will report numbers later this morning.

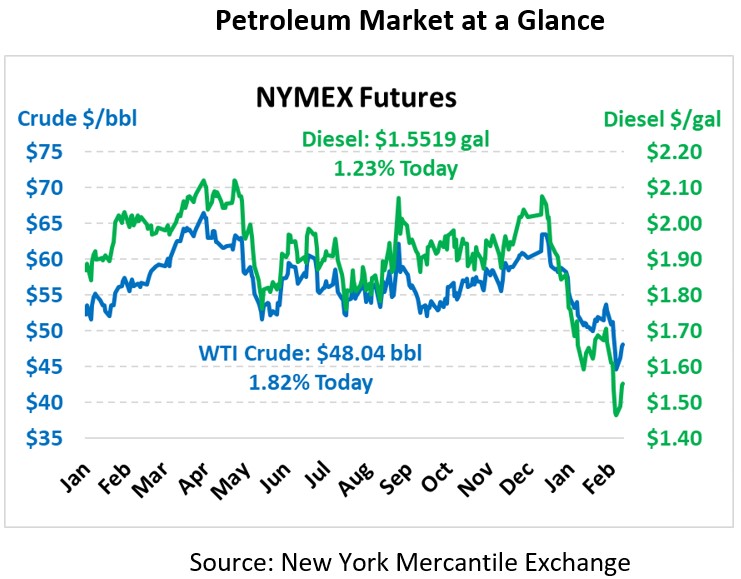

Crude prices are up this morning. WTI Crude is trading at $48.04, a gain of 86 cents.

Fuel is up in early trading this morning. Diesel is trading at $1.5519, a gain of 1.9 cents. Gasoline is trading at $1.5552, a gain of 2.4 cents.

This article is part of Crude

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.