Economy Grows, API Shows Continued Refined Product Draws

After shedding a dollar yesterday, crude prices are beginning to tick higher this morning. The OECD, an international organization focused on economic growth and trade, released an interim guidance report on economic growth, in which the group raised their 2021 global GDP forecast to 5.5%, supported by a rapid vaccine deployment and stimulus legislation. The report also echoed Federal Reserve Chairman Powell by advising countries to maintain loose monetary policies, even if that allows excess inflation in the short-term.

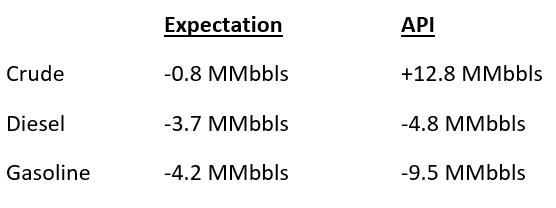

The API released its weekly inventory report, which showed another massive crude inventory build accompanied by steep refined product draws. Markets had been expecting substantial drops in diesel and gasoline inventories, but the crude oil increase was a sharp deviation from expectations. The data reflects on-going refinery utilization struggles in the Gulf Coast, and the EIA’s report later this morning will help confirm how severe the effect of refinery outages will be.

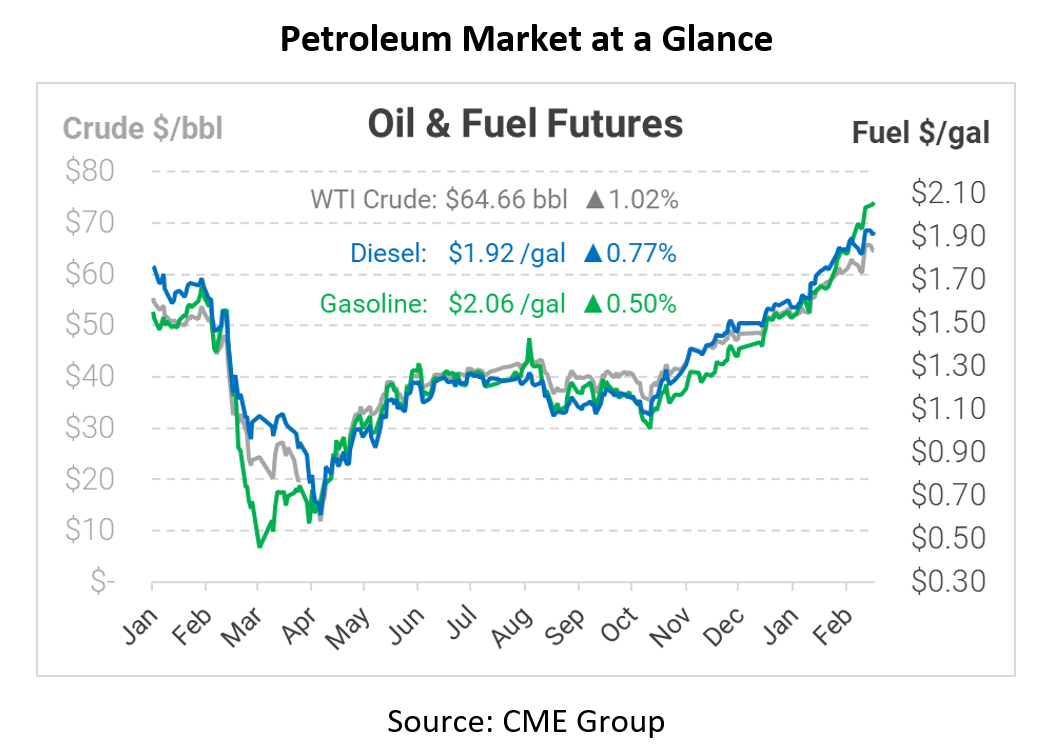

The oil market is heading up today, recovering from yesterday’s losses. Crude oil is trading at $64.66, up 65 cents (1%) from Tuesday’s closing price.

Fuel prices are also on the rise. Diesel prices are trading at $1.9219, gaining 1.5 cents (0.8%) from Tuesday. Gasoline is lagging the market with just 0.5% growth, trading up 1 cent to $2.0605.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.