Diesel Inventories Grow for Ten Straight Weeks

On Tuesday, WTI Crude finished slightly higher as investors weighed OPEC+ production cut extensions versus broader negative economic sentiment. This morning, markets are down as traders are pricing in bearish inventory news from the API report that came in late yesterday. The EIA’s overall bearish report this morning is also pushing markets lower.

Diesel stockpiles have grown for ten straight weeks, and inventories are at levels not seen since 2010. Several factors have led to the ongoing diesel glut:

- Jet fuel is in low demand because the airline industry has not yet recovered, so refineries are minimizing jet fuel output. Because jet fuel is chemically similar to diesel, they are blending jet fuel with distillates to produce more diesel fuel.

- Unlike Europe, where consumers use diesel for personal transportation, US consumers predominantly use gasoline. As such, gasoline demand tends to follow consumer trends, while diesel demand is more closely linked with economic and business activity. Still, refineries trying to keep up with gasoline demand are forced to produce additional diesel as a by-product, which will keep inventories rising as gasoline demand returns.

- Finally, freight, farming, and construction equipment are the primary users of diesel in the US, and that industrial and agricultural demand has yet to return to levels capable of using the excess diesel.

It is not possible for refineries to completely stop making diesel and jet fuel, especially if they increase runs to meet the demand for gasoline. Therefore, a diesel glut will likely persist until there is a broad economic recovery, including a resumption in air travel.

EIA and API data last night:

The API reported a large surprise build for crude of 8.4 MMbbls versus an expected draw of 1.7 MMbbls. The EIA’s crude numbers came in below the API’s report, but still showed a large build. At Cushing, stocks decreased by 1.7 MMbbls. The EIA’s diesel numbers showed a smaller-than-expected build, perhaps signalling a slowdown in record builds. Gasoline stocks posted a medium-sized build, contrary to the API’s report.

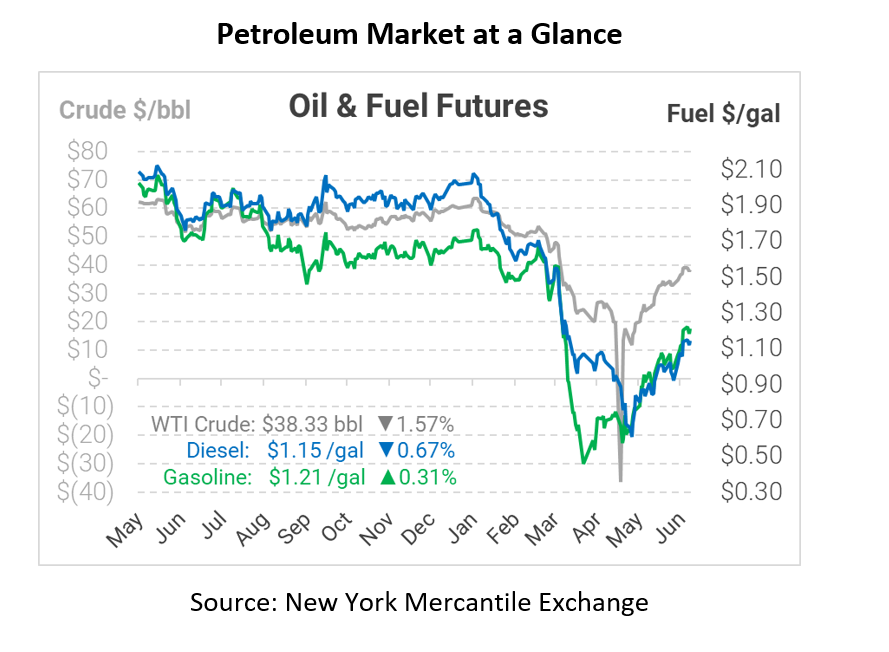

Crude prices are down this morning. WTI Crude is trading at $37.94, a loss of $1.00/bbl (-2.6%).

Fuel is flat in early trading this morning. Diesel is trading at $1.1471, a small 0.8 cent decline. Gasoline is trading at $1.1883, down 2.2 cents.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.